Dear Valued Clients and Friends,

The fog of war continues in Ukraine with the entire world watching. The path to some immediate resolution has mostly closed, and expectations are for a complicated and extended process. Prayers are for minimal bloodshed and certainly for a limited scope to where the conflict goes. But few analysts are able to formulate a scenario where this ends well.

The dollar is rallying. The Euro is collapsing. Oil is skyrocketing. U.S. equity markets are experiencing significant gyrations up and down day by day. Commodity prices are higher. I believe those five sentences summarize the five most important themes in financial markets right now (the collapse of the ruble and the Russian equity markets does not make the list, because who cares).

I could certainly provide commentary today on the history of how markets have responded to various geopolitical distresses over the years, and maybe that will be needed in the weeks to come. But I believe longtime readers of Dividend Cafe know that I believe a properly constructed asset allocation is supposed to account for the inevitability of, well, distress. It could be geopolitical, or medical, or monetary, or economic, but distress is not new – only the specific reasons for the various particular distresses that come at different times. Today we are going to look at the reality of addressing distress in one’s portfolio through asset allocation – what it means in the current moment, how some elements of this have changed, and why it hasn’t stopped mattering.

I wouldn’t say this is a specifically Ukraine-focused Dividend Cafe, but I would say that it may feel like it if it is understood correctly. We hold principles for the purpose of applying them during times of distress. The Ukraine event is a time of distress. Today’s Dividend Cafe is about the principles that exist before, during, and after such.

A Conflict of Visions

The incomparable economist and social theorist, Thomas Sowell, wrote a masterful book called A Conflict of Visions when I was entering high school 35 years ago wherein he identified one’s view of human nature as the root explanation of how one feels about most issues of political and social division.

His fundamental thesis was that there exists an “unconstrained” vision that views human nature as malleable and conditions as mostly perfectible, and then a “constrained” vision that views human nature as immutable and conditions as permanently subjected to the reality of trade-offs.

You can guess which vision of society I hold to.

But the reason I bring up Sowell’s profound and highly regarded commentary on political epistemology is that I believe the dynamic and divide he identifies as so prevalent in our social and political leanings is highly prevalent in one’s investment worldview as well. I encounter thoughtful investment professionals frequently who believe that the fundamental composition of market principles are constantly changing, and I encounter others who intuitively believe that some laws of investing are engrained in the universe, with only adjustment of application the need of the hour.

Again, I will let you guess which vision of investing I hold to.

A pre-emptive strike on the straw man

An easy way to discount the views of the principle-based investor is to accuse him or her of not “keeping up with the times” – of not understanding that things change. But what is at debate is not whether or not change is real, but rather what kind of change we can be expected to encounter.

If I said one day we may have to count four pencils, but a decade down the line we may have to count four iPads, I have not suggested that 2+2 no longer equals four. I have maintained the principle of math while recognizing that what that math is being applied to is ever-changing, even as the laws around the application are not.

Things do change. Laws and principles do not. So applying unchanging laws to changing things requires wisdom, and reasonable men and women can disagree about how these applications should work in certain circumstances. But a belief in the immutability of certain universal principles is not remotely inconsistent with recognition of changing externalities.

A caution

I would be far less worried about investment advisors who are allegedly slow to respond to “change” than I would be about those who are constantly singing the tunes of “paradigmatic shift.” Those who see revolution in every sunset are not to be trusted. Revolutions happen. And certainly, sunsets happen. But the impulse, the trigger-happy instinct that believes the entire natural order is always and forever being reinvented, is dangerous. For many investors, it can be fatal.

I avoid these drama queens like the plague. Their root philosophy is wrong, and the way in which they apply it does unspeakable harm to people.

In all thy getting, get wisdom

Because I recognize the reality of change, progress, revolution, and disruption, and at the same time resist the instinct to believe that all we know is constantly becoming worthy of dismissal, I am forced to hold two things in tension – and that process requires wisdom. I do not pretend it is easy. I believe it requires humility, and I further think if that humility is lacking, it will be provided for you eventually and inevitably.

The need for wisdom is in how to see various changes in facts and frameworks that necessitate a changing investment application without succumbing to the insanity of abandoning laws and principles. I find this easier when it is rooted in an instinct to respect tradition, history, rules, and facts about nature (which is to say, human nature).

But at the end of the day, someone has to “drop a ticket” (that is parlance in our business for actually buying or selling a real-life investment). All the philosophy and armchairing in the world is useless until a decision gets made and execution takes place. Those executions ought to reflect a cohesive and coherent plan and strategy, and those plans and strategies ought to be rooted in a worldview. But for a goals-based investor what matters is how it plays out – how one’s financial goals are positively or negatively impacted by the actual decisions made.

How to define diversification

The laws of asset allocation have not changed. The combination of various asset classes to create a blended risk/reward experience remains the primary determinant of investment results. Various asset classes that provide little correlation to other asset classes represent diversification whereas highly correlated asset classes provide only the appearance of diversification.

This latter point is important – ten asset classes that do almost the exact same thing is not diversification; three asset classes that zig and zag in different directions for different reasons is diversification.

Volume does not create diversification; non-correlation does.

Why we diversify

The simplest way to say it is this: We diversify the investments intended to provide us a given return to limit the risk of a specific investment’s failure and to smooth the impact of inevitable asset class volatility. And why do we do the latter? To help increase the odds of an investor behaving – of preserving their peace of mind so as to keep them in their seat long enough to enjoy the benefits of what their investment portfolio is intended to do.

You can also argue that diversification is intended to aid the process of compounding capital. The larger a downside drawdown, the more difficult the math is on the upside to restore positive compounding. A smoother experience enhances total return over time, because of math.

How we diversify

There are two things investors have generally done here, correlated to one another but not the exact same thing. One is to find an asset class for the purpose of injecting some “safety” into the portfolio. In a portfolio of risk assets, there is generally some benefit to having some component (weighted differently by each investor’s own conditions and profile) that can hang in there when things go very poorly.

This “safety injection” is also one of the ways that non-correlation gets put into a diversified portfolio. It not only represents “if all else fails” money, but it serves the purpose of non-correlation in a portfolio. It zigs when other stuff zags. In that sense, it can kill two birds with one stone.

How we have diversified historically

I think the most common approach since the advent of Modern Portfolio Theory has been the notion of a 60/40 portfolio – meaning, 60% allocated to stocks and 40% allocated to bonds. The idea with a 60-40 portfolio was that the volatility one would experience here would be generally tolerable for most investors and that the events which sometimes distress the 60% equities would be offset by the zigging of the 40% in bonds, yet without giving up too much return from the 40% bonds during the normal periods of non-distress.

The new but not new reality

I believe the principle of non-correlation is firmly intact, and at the same time have believed since our Fed adopted a zero-bound approach for monetary policy that caught on in the long end of the curve (that is, longer-dated bonds like the 10-year found a 1-2% yield) that “boring bonds” would not provide the same non-correlation to equities that they historically have.

This was not because the principle changed – non-correlated asset classes still provide a blended risk-reward experience as opposed to a leveraged one or a non-diversified one.

But the specific application of treasury bonds to the concept has changed because the yields of treasury bonds have changed, and I would argue they did not merely change marginally (a 5% going to 4%), but they changed paradigmatically (the hugging of the zero-bound eliminating their advantage in hedging tail risk).

Recent events

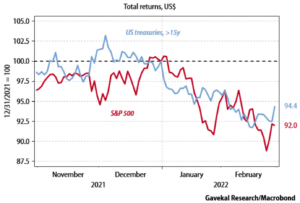

A microcosm of what I describe is evident here While energy stocks and a focus on dividend growth has (at least so far – it can change at any time) left us mostly out of harm’s way this year in stock market distress, the broad market indices are all down about -10%. But the more noteworthy piece is the other asset class – that “non-correlated diversifier” known as Treasury bonds:

What to do?

We elected to substantially lower our allocation to “boring bonds” in 2020 because of this expectation, basically using the asset class as a parking lot of dry powder for potential deployment into risk assets in the future, or as a mere carve out of principal protection. But its role as a zig to the zag of equities has been diminished severely.

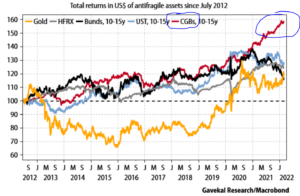

Note what has become the optimal “safe” asset over the last ten years:

Yes, Chinese government bonds have outperformed (by a wide margin) U.S. bonds, German bonds, gold, etc. I have written plenty as to why this is and what it all means in terms of global strategy, but my point is that the principle here did not change, but a potential application for it did.

So what does asset allocation look like from here?

I believe that alternative assets from hedge funds to private equity to real estate etc. become more important in a portfolio going forward, not because the laws of asset allocation changed, but because the need for non-correlation remains intact, while the instruments that provide it have endured circumstantial adjustment. I believe the search for “anti-fragility” – that safe asset, continues. Alternatives do not scratch that itch – they provide a risk that is not “the safe rate” – even though their risk is [ideally] outside of that of traditional stocks. And while Chinese government bonds may not be the new Treasury bond, we are living in a period where the search for a replacement to Treasury bonds in a portfolio context is potent.

No country has behaved like they want this safe-haven status (in terms of fiscal or monetary policy).

Conclusion

So while the focus on the risk-free part of a portfolio continues to ebb and flow, the focus on the risk part of a portfolio continues: Dividend Growth in an uncertain world to provide the most distinguishable and definable part of an equity return – its growing cash flow.

And while we look to zig around the zag of risk assets we will continue in our vigilant pursuit of non-correlated alternative investment options.

It isn’t our fault. Treasuries caused us to change our application.

But never to change our principles.

Chart of the Week

Is residential real estate that “anti-fragile” safe asset? Or is it part of the inflation everyone says they want to counter?

Quote of the Week

“But human nature is more intractable than ant-nature. The explosive variations of its phenomena disturb the smooth working out of the laws and forces which have subjugated the White Ant. It is at once the safeguard and the glory of mankind that they are easy to lead and hard to drive. So the Bolsheviks, having attempted by tyranny and by terror to establish the most complete form of mass life and collectivism of which history bears record, have not only lost the distinction of individuals, but have not even made the nationalization of life and industry pay. We have not much to learn from them, except what to avoid.”

~ Winston Churchill

* * *

Enjoy your weekends and reach out any time with any questions. Getting these portfolio challenges right is the reason for our being, and to that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

dbahnsen@thebahnsengroup.com

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet