Dear Valued Clients and Friends,

Greetings from Nashville, Tennessee, where I will be necessarily giving you a shorter Dividend Cafe today, but one you may find quite interesting nonetheless.

I am sure some of you would prefer we just stay out here in Nashville. But alas, we live in crazy times.

And speaking of crazy, I want to talk today through a few charts, quickly, that cover the subject of energy investing and technology investing. The angle is a bit different than many choose to take.

Let’s jump into the Dividend Cafe …

|

Subscribe on |

Housekeeping

(1) First things first … we did cover the “morning after” midterms in the DC Today on Wednesday. It is available here if you are interested.

(2) The huge market day yesterday came as bond yields collapsed (which means bond prices rallied), the dollar dropped, and the terminal rate implied for federal funds dropped 25 basis points in the futures market (reminder – a basis point is 1/100th of a percent). The % gains in some aspects of the stock market were simply unbelievable.

(3) The catalyst for #2 was the Consumer Price Index report for the month of October. I will re-hash it all in the DC Today on Monday, but a trend of disinflation is coming, was apparent, is even more apparent than the data reads when one unpacks the specifics, and caused expectations of Fed policy to be dramatically re-priced very quickly. Whether or not these expectations prove accurate, and whether or not the market response to changed expectations proves sensible, is another subject for another day. But the data was what it was, and I will be talking through it in detail in Monday’s DC Today.

Okay … now we start.

Three phases in Energy and Tech

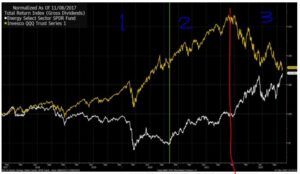

The chart below shows three things in recent times I want to highlight:

(1) The big rally in tech and the secular decline in energy stocks that was taking place for several years before COVID, and then, especially through the 2020 COVID year.

(2) The rally of BOTH sectors that began in November 2020 represented a reversal rally for Energy, but a continuation rally for Tech (this lasted through 2021, where a rising tide lifted all boats)

(3) The sharp divergence of 2022, where Energy has violently rallied, and Tech has sold off substantially.

*Bloomberg, Nov. 8, 2022

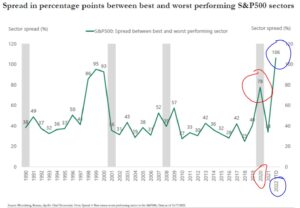

Coming Apart

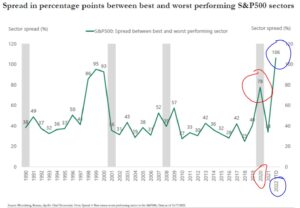

The spread between Tech (good) and Energy (bad) was record-setting in 2020. The spread between Energy (good) and Tech (bad) in 2022 has broken the 2020 record.

Unequal pain

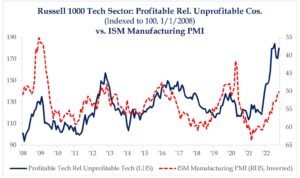

Within the realm of sectors that had very challenging years, not all pain was equal. I have commented a lot that the “shiniest” of objects got hit the hardest as crypto, “work from home” stocks, and other forms of non-profitable cloud and software names, as well as “lockdown” favorites with brand names, were taken down -70% to as much as -90%.

The red line in this chart is not really my focus – just the blue line. It captures the performance of PROFITABLE tech companies relative to UNPROFITABLE ones since the financial crisis. Notice how well the unprofitable side of big tech did from 2016 to 2020, and how much that has reversed in the last two years.

*Strategas Research, Daily Macro Brief, Nov. 10, 2022

All of it is down this year, but the higher quality has done a lot better than lower quality.

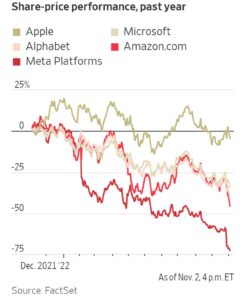

The Mighty Have Fallen at Different Levels

Within the so-called “FAANG” world of big cap tech names, there has been big divergence – with the largest market cap company in the country, Apple, down, but not nearly to the degree names like Facebook (Meta) and Netflix are. *news source – https://www.marketbeat.com/types-of-stock/faang-stocks/

Valuations don’t tell the whole story

I have long argued that the biggest concern with “good tech” – meaning, the “big tech” companies that obviously have good businesses, was their valuation. One can love a company and hate a stock price. Highly monopolistic advantages and massive brand appeal are important, and carried the big tech companies from 2013-2021 – but when a stock price gets over-priced, it really doesn’t matter how good a company is. And that re-pricing was inevitable.

But now, there are some fundamental things at play, one of them being profit margins. Revenues are declining or flat-lining as expenses are not, and huge layoffs are being announced to counter what seems to be the beginning of a real decline in margins.

*Strategas Research, Daily Macro Brief, Nov. 11, 2022

And yet …

Fundamentals good or bad, valuations have been a by-product of multiple expansions from declining bond yields; as bond yields rose, valuations collapsed.

*Strategas Research, Daily Macro Brief, Nov. 11, 2022

Is it all relative?

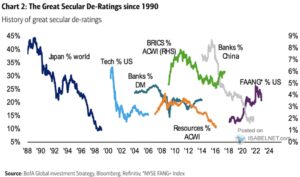

When you look at the historical “relative” re-pricings that have taken place over history, one could argue big tech’s relative re-pricing within its macro market (see a variety of comparisons here) has room to go.

Silver lining

I remain of the belief that investment policy should not be formed by outlook on valuations (one way or the other), but by cash flows and the return of cash flows to shareholders. I want to be very clear – it is the reliance on a growing multiple to make money that turns me off to big tech investing; NOT a market call that multiples will decline. In other words, I am not making a call about a declining P/E ratio in tech; it is simply that I am not interested in confidently predicting an expansion of such. Being reliant on something that seems improbable or idiosyncratically unpredictable is not a good investment policy.

Some good companies are cheaper than they once were. Some bad companies have gone away meaning capital can be reallocated in a better way now.

Some investors have gotten “dotcommed” this year, and that will make them better investors going forward.

How do I know this? As the Apostle Paul once said, “such were some of you.”

You are talking to a dividend growth investor that learned the most important lessons he ever learned from getting dotcommed.

Great things lie ahead when we learn from our mistakes.

Quote of the Week

“Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold.”

~ Warren Buffett

* * *

Reach out with any questions, as always. Our team is absolutely on fire here in Nashville – and I can’t wait for what we are doing to further improve our business. More to come on that front …

Count on a heavy-duty DC Today on Monday.

And may your weekend be a delight. This is just an absolutely wonderful time of year.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet