Dear Valued Clients and Friends,

We live in interesting times. Is that fair to say? Does anyone disagree with that? I didn’t think so. Now, I didn’t say, “We live in unprecedented times.” I think there are a lot of reasons to barely ever say that (Ecclesiastes 1:9 is a good place to start). I certainly understand that some things seem unprecedented, and many times the particular manifestation of something may be unprecedented. But honestly, most of the time, people say something is “unprecedented,” they are just a person who does not value the study of history very much.

I value history a lot. I believe in almost all disciplines, a better understanding of history is needed for a better understanding of the present and to be prepared for the future. Current social unrest is not unprecedented. Neither is political tribalization. Neither are class divisions or any of the many other things adding to societal angst. It is somewhat arrogant to believe we are the first people in the first time in history to experience a certain thing.

So I prefer the word “interesting” to “unprecedented.” And one of the things most “interesting” right now is the state of corporate America. For some, corporate America is not doing enough to save the environment or participate in various social or political causes. For others, they have stepped knee-deep into a political and cultural agenda that is detrimental to their well-being as a company.

Today I want to talk about the concept of shareholder engagement, what it means, what it ought to mean, and what The Bahnsen Group is doing in this regard. You may find it not political or audacious enough. You may find it too opinionated. You may find it outside the core of investment advice. You may find it the heart of investment advice.

All I can tell you is – you won’t find it “unprecedented.”

Let’s jump into the Dividend Cafe.

|

Subscribe on |

Duty of care

First things first, even if it seems outside the theme of the day (it is not) … To whom does a company owe its ultimate duty of fiduciary care? Does a modern public corporation have an underlying responsibility to its owners, to someone else, or to both? Ironically, this is a question that would have been unfathomable to ask decades ago, and really even up until a few years ago. Milton Friedman famously wrote in the New York Times in 1970 that the ultimate social responsibility of companies was to pursue a profit for its owners. His often-misunderstood and (purposely) misrepresented article made the case that to put the burden of certain extra-curricular social objectives on companies was to violate the legal duty of care public companies had to shareholders. It was a technical (and accurate) argument, but it also was rooted in certain market principles that are as true now as they were today …

(1) That in a market economy with competition, the open flow of labor, trade, and capital, and freedom of exchange, there would be ample incentive for companies to take care of their employees. If one company underpays an employee, they risk losing that employee to another company. Just as prices charged to customers becomes a trade-off around profits and competition, so do expenses like labor costs, etc.

(2) That in a market economy with competition, the open flow of labor, trade, and capital, and freedom of exchange, there would be ample incentive for companies to value their reputation, to pay their bills, to do well by their vendors, and to desire a standing in the marketplace that would attract investors, customers, suppliers, and other such economic actors needed to their underlying mission. It is the lack of market mechanisms that takes away the incentive to do these things right and do them well; the reality of a market economy is the best facilitator of good behavior. It can’t be perfect because we live in an imperfect world, but it has proven to be a better principle for organizing society than other command-control systems have proven to be.

A number of years ago, the Business Roundtable suggested that rather than exist to serve shareholders, the modern corporation existed to serve all stakeholders. It included in that broad and rather ambiguous term the “community at large” – a definition many felt was so broad and all-encompassing as to be worthless.

I can pretty much prove that a company’s primary duty of care is to its owners and not the “community of mankind.” If you invest $1,000 with me for a lemonade stand I am going to start, and I take your money and give 100% of it to the Orange County Rescue Mission and never open a lemonade stand, I will have given your money to a first-rate charitable organization that does extraordinary good for the community. And you will sue me (and win) to get your money back.

Sorry, but some things, no matter how adorable they sound, do not stop being stupid things to say just because they are well-intentioned. And my friends, the idea that a company does not owe its duty to its owners because it instead has an esoteric duty to “the world” is a stupid thing to say.

What I didn’t say

I’m ready for what comes next. “Are you saying companies have no responsibility to the environment, or the neighborhoods around them, or to any aspect of social and ethical responsibility?”

First of all, no, I am not.

Second of all, I will do you one better. I actually think you have a responsibility not to be a horrible person. And me. And that man over there. And that woman over there. All of us. Each person. Don’t be evil. So no, I am not punting the notion of personal and ethical responsibility. I am leaning into it. I think all of us have a heavy personal responsibility to live according to a moral code.

But third, let’s be clear. I am talking about “spheres of responsibility.” The purpose of a company is to deliver goods and services that meet the needs of its customers at a profit. It employs people. It requires component parts along the way. It attracts capital. It takes risks. It does things. But it exists in the sphere of its own business model. And while I want my kid’s high school to have decent food options in what it serves the students, its sphere is to educate and teach. Its primary duty is not to run the best cafeteria in the world or branch out into the world of top-shelf bowling alleys. A lane is a lane (see what I did there), and they need to stay in their lane.

A software company should not burn down South American rain forests as a joy ride, yet it really should make software more than it seeks to solve ozone impairment.

This is not hard. Things can be good things that are not the duty of you or me to do. We are constrained by the doctrine of moral proximity, and we are constrained by our core missions, skills, and focus. Asking a corporation to bring about world peace is childish utopian drivel.

Back to Engagement

Now, sometimes the frustration people have with big companies may not be that they are not doing enough “social responsibility” stuff (whatever that category may mean to a particular person), but rather it may be that they are doing too much of it, and more specifically, a kind that is outside one’s own value or belief system. Many investors, myself included, have been outraged at the various diversions into certain culture war issues and/or various poorly-defined (and often token and hypocritical) “ESG” endeavors (defined cosmetically as the Environment, Social, and Governance movement). Yet some are animated because a company is doing too much, and some are animated because they believe are not doing enough. There are a lot of categories of angst out there.

So just so we are clear – in a free and democratic society that is (at least structurally) pluralistic, we can (and do) have people who believe companies are:

(1) Doing too much “ESG” stuff

(2) Not doing enough “ESG” stuff

(3) Doing too much left-wing culture stuff

(4) Not doing enough left-wing culture stuff

(5) Doing too much right-wing culture stuff (okay, just kidding; no one actually believes that!!) LOL

And so the question is – what does one do when a company out there is doing one or more of those four things that potentially go against their own value system, or perhaps as a different category of frustration, eroding the value of their investment?

Value vs. Values

As an equity investor, I believe (with Milton Friedman and hundreds of years of legal tradition) that companies have a fiduciary duty to their owners and that maximizing profits is why the company exists, with the natural restraints that a properly-ordered society and market economy present. I donate money to non-profit groups and religious or social organizations and causes I believe in for philanthropic reasons, and I invest money (and the capital of our clients) for financial reasons. That these two adjectives are not the same and function in a different sphere is a matter of obvious vocabulary that only a virtue-signaling pharisee could miss (or a grifter and charlatan, but I digress).

But I do have a values system, too. So do most (all?) of you! I oppose X in the public square, and I really like Y. Same for all of you. So where do the goals for finding value (investors) and values (our belief system) coincide?

I have long believed that in a broken world, no one can even come remotely close to avoiding contact with the things they do not like. If they said, “No stocks or bonds, I don’t believe in any of these things happening – I am leaving my money in CDs at the bank!” – they would simply be leaving it there for a bank to lend it out to all these companies that they don’t want to invest in. If they bought T-bills, they’d be lending money to the federal government, who, chances are, does a few things they don’t like (the list of what they do we like will be a lot shorter than the other list, I assure you).

So we have to make decisions around conscience, reality, sphere sovereignty, and matching objectives to a solution. To those ends, we work.

Boycott or engagement

I am not a big fan of taking on a company for doing X or not doing X or doing Y or not doing Y when I do not own the company. That is more pure activism, and while I am not in a position to tell others what to do, I believe it is a different category than what I am referring to.

I also am not a big fan of taking a great company that does something really well and would be an asset in my work on behalf of clients and saying I will boycott ownership in it because they are doing X or not doing X or doing Y or not doing Y (fill in X and Y with your own culture issue or ESG issue or whatever). In fact, I believe I have a fiduciary duty to NOT do that! I owe a standard of care, and investment returns are our lane – and we do it to a really thoughtful investment philosophy that we believe in with every ounce of breath in our bodies.

But that does leave another option, the one we are jumping into enthusiastically.

- Engaging companies we do not own to effect social change – NO

- Boycotting the stocks of companies we believe are good investments – NO

- Engaging with companies, we think are hurting shareholders (us) with bad decisions or questionable priorities – YES!!!

You lose all the games you don’t show up for

There are always resolutions at the shareholder meetings of public companies that shape their policies and practices in these matters.

And shareholders (of a certain criteria, but it is most everyone) can always present resolutions and ideas for discussion and a vote at shareholder meetings.

And shareholders get to vote on members of the board of directors.

And shareholders can talk directly to investor relations and, in some cases, with the right savvy, muscle, and gravitas, talk directly to corporate management about matters of importance to us as shareholders.

These are rights shareholders have in basic corporate law.

And they are rights that we are going to start using a lot. And we are doing it only where it is a question of shareholder value and investor returns, which is not just our right but our duty.

In the weeds

The details matter. Proxy services exist that provide votes for shareholders, and they are large and powerful, but they are not necessarily aligned with us or our views on things. We do not want to abandon good stewardship, but we do want a more ENGAGED (not activist) view of stewardship. So we will do just that. We have contracted (at our dime entirely) with another consulting service to provide thorough research on these various shareholder matters and, in some cases, to pursue resolutions directly. We will vote. We will talk to management. And we will do this with companies we want to own as good investments.

If you are a client of our firm, this is a value-added component that will come with no additional expense to you. It does come with an additional expense to us – the research, process, vetting, administration, and legal side all take a lot of work. But it is worth it to us.

Not only because we have a republic to preserve, but yeah, that too!

But we owe you certain returns and investment excellence. And to that end, we work, in this case, with engagement, not boycott!

Chart of the Week

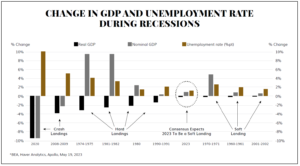

For all of the talk about how things shake out with recessions, just note that we have a couple of doozies (COVID, GFC), some “bad” ones, and then several “soft landings.” There is historical precedent for all scenarios, and “one size fits all” recession theories are uninformed.

Quote of the Week

“My faith inspires me when I most need inspiration and consoles me when I am most in need of reassurance that my life has a value and a meaning, especially when public comment and even harsh introspection lead me to consider the opposite conclusion.”

– Conrad Black

* * *

Your advisor will reach out with more specifics if you are interested in understanding this more. I have been aggressively working on all of this for quite some time, but as I prefer in all I do, I really did not want to jump in half-cocked without proper reliance on first principles. The actions people take need to be rooted in defensible beliefs. I think we have done the work necessary to now be in action. And I swear from the bottom of my heart we are animated by one thing and one thing only – that which is best for our clients.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

dbahnsen@thebahnsengroup.com

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet