Permission Granted

I’m writing today specifically to give you permission to transact.

If you’ve met with your family and your financial advisor and you’ve collectively decided that it makes sense for your financial plan to acquire a new property – do it.

If you’ve met with your family and your financial advisor and you’ve collectively decided that it makes sense for your financial plan to sell a property you currently own – do it.

I’m seeing too much concern/anxiety out there about where real estate markets will go from here and how to best “time” one’s next real estate transaction. I don’t see a lot of value in speculating or prognosticating about where your gut (or my gut) is telling us about the direction of real estate prices. My encouragement today will be on the importance of patience and how fear and greed typically cause the most damage.

Note, the focal point for me today is more on one’s primary residence or second home. There is a different type of analysis when discussing investment properties. For investment properties, we’d most likely be juxtaposing multiple opportunities and concluding which poses the optimal risk/reward outcome. The acquisition or sale of a residence – your home specifically – will have more qualitative factors that need to be weighed, assessed, and considered.

A Look at the Landscape

Let’s pause here just to take a lay of the land. There have been a lot of factors over the last few years that have caused housing prices to rise quickly and recently for transactions to slow down.

First, what’s been driving home prices? If you look at demographics (demand), you’d see that the largest population segment by age is 30-somethings, these are your first-time home buyers and second-home upgraders.

*Source: www.usafacts.org

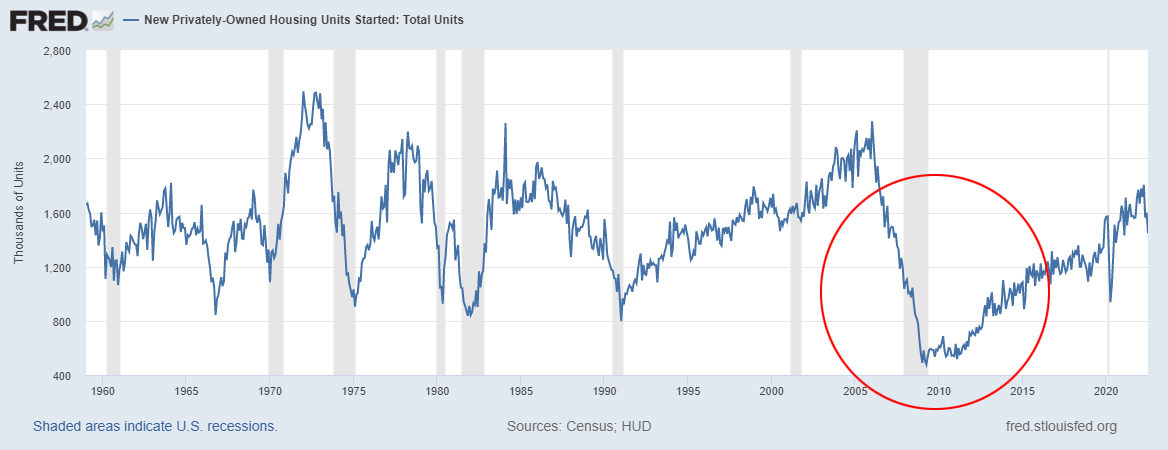

If you looked at new home builds (supply) over the last 20 years, you’d see a significant dip post-2008, the collateral damage of the Great Financial Crisis.

Beyond demand outweighing supply, you also had two other key incentives amplifying prices. First, low borrowing rates went even lower as the Federal Reserve’s accommodative policies post-COVID drove down interest rates.

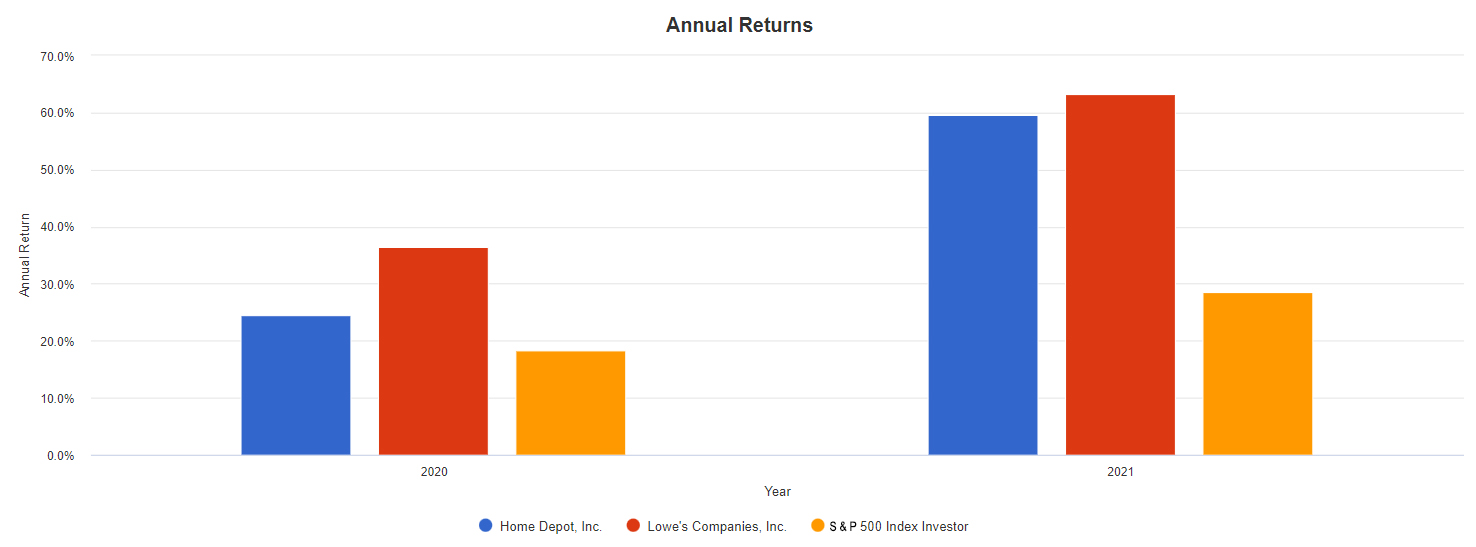

Second, the government’s restrictive policies around COVID – and employer’s accommodative work-from-home policies – drove this new “homebody” culture. As folks spent more time at home, they wanted nicer spaces and more space, again driving upgrade-purchasers and a home improvement boom – as reflected in home improvement retailer’s stock prices.

*Source – Portfolio Visualizer

A Slow Go

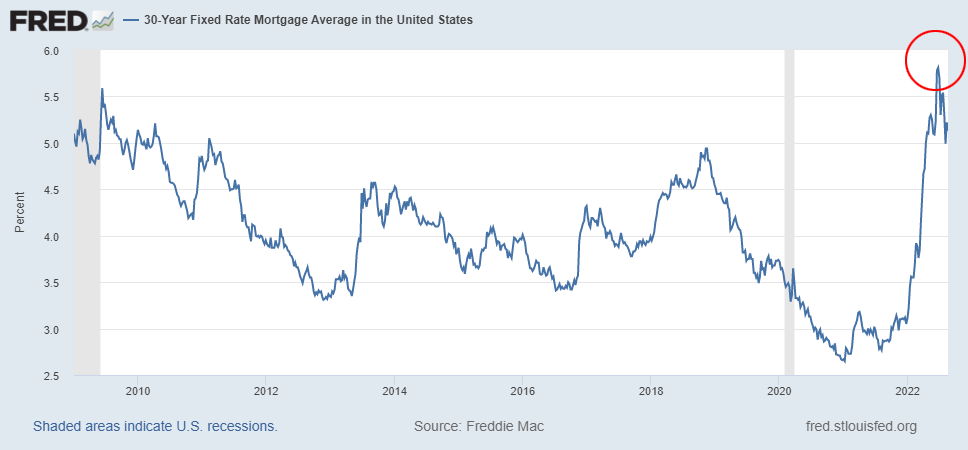

Next, what’s recently slowed down real estate activity? The first domino to drop was the changing posture of the Federal Reserve. A shift from the 2020 mentality of whatever-it-takes accommodation to a whatever-it-takes tightening cycle to combat inflation. These actions have driven the 30-year mortgage to the highest rate we’ve seen post-financial crisis (2008).

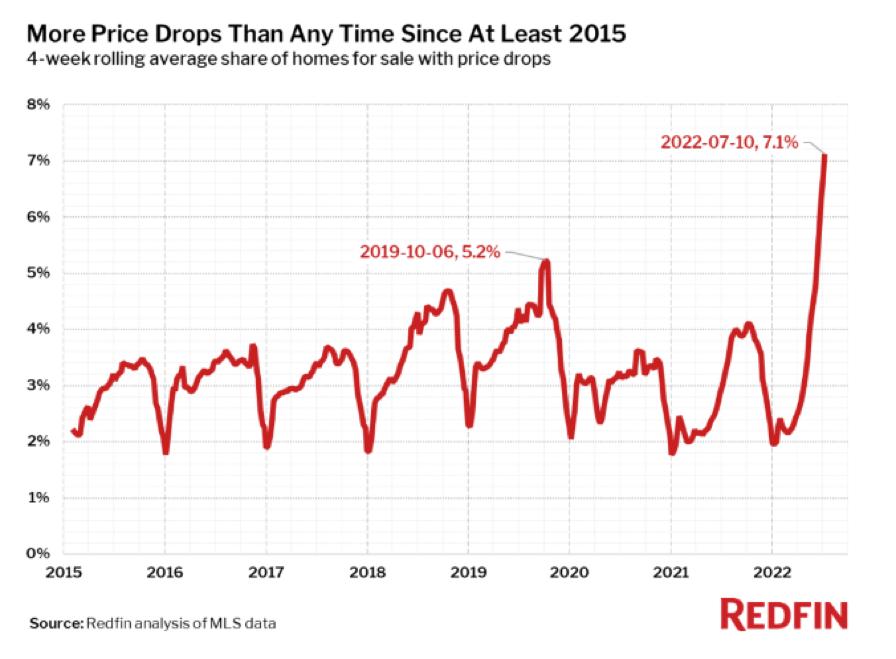

As David Bahnsen often says, “People buy a monthly payment, not a home’s sticker price.” Rising mortgage rates drove higher monthly payments, which softens demand based on affordability. Naturally, homes stayed on market a bit longer, inventories rose, and this change in climate began to instill a bit of fear and greed. Buyers became fearful of buying at a top, and sellers who’ve come accustomed to certain comps were being stubborn about sale prices. Now, we have seen a softening in home prices as sellers begin to capitulate a bit.

These changing-of-the-tides moments often happen gradually – as mentioned, sellers have had the upper hand for some time now. We saw the pendulum swing pretty far with expectations from sellers of short escrow periods, only accepting all-cash offers, appraisal waivers, and such. This is how we typically see markets work – a structural or fundamental change causes a market to shift or pivot, and then the sentiment of the market participants will amplify or accelerate the pace of that change.

The Tale of Two Purchases

So, where does that leave us today? With a lot of scared and confused people who wanted to buy or sell but now find themselves sitting on their hands. Before I give my advice, let me tell you about my personal experience with buying my last two homes; the tale of two purchases.

My first purchase was in October of 2019. My wife and I had visited about a dozen open houses, and we were ready to make a purchase. We found about three houses we were absolutely in love with, and each time we placed an offer above asking within the first week or so on the market. We absolutely struck out, that’s right, 1-2-3, and you are out of the old ball game. Not even a counter offer or an opportunity to make a go at one of these properties. To add insult to injury, we came across a 4th property, attempted to put in an offer, and the selling agents said, “No need, we already have enough offers.” I can’t put into words how frustrating and disappointing this process was.

My wife and I were fed up with this process and started thinking outside of the box. Our good friends wanted to sell their home to fund a new build they were working on but needed some lead time before their project was completed. We made an offer to buy the property and rent it back until their new residence was move-in-ready. One year later, we moved into our new house, and it was a wonderful experience, especially compared to what we had endured.

And our family continued to grow…

We needed more space…

So, we copied the process. I reached out to a friend with a beautiful home, one I was well acquainted with, and let him know to keep me in mind if he ever wanted to sell. Eventually, that interest surfaced, and we transacted in Q2 of this year. He needed to downsize, we needed to upsize, so naturally, we bought each others’ homes 🙂

One of these purchases I bought at a low, unintentionally, and one of these purchases I may have bought at a high, unintentionally. The common theme, though? Patience. Now, don’t get me wrong, patience won’t cure everything, but it will disinfect 99.9% of most of the issues/mistakes that I commonly see. It’s important to remember, though, patience applies to the acquisition, the holding period, and the disposition of a property.

Anchoring

Above I mentioned that I “may” have bought at a high point in the market. I don’t know this to be true, but it very well could be. It also doesn’t matter. My first purchase appreciated by nearly 70%, which is nice, but I wasn’t going to “profit” from that reality – my family needs somewhere to live, and it is natural that this equity would just roll into the new purchase.

Here’s the thing, I didn’t let my feeling about peak prices influence my purchase decision. Not because I was throwing caution into the wind or not being thoughtful, I was prioritizing my family’s dreams/goals/desires over getting a “good deal.” I know with long holding periods, overpaying slightly or underpaying slightly becomes very diluted. I also know this asset might appreciate, but it is more my home than an investment on my balance sheet.

I get concerned that those chasing a good deal may find themselves anchored to the past. Whether that is when home prices came down post-2008 or even what their neighbor may have sold for recently. Whatever is driving this feeling – fear, envy, frugality – I think it can be a distraction and unhealthy.

Open Minded

The reality is, that the real estate environment has changed. And when an environment changes, sometimes you need to be willing to be prudently creative in how you buy or sell. Maybe a buyer resources an interest-only loan during this tightening cycle that they plan to refinance later. Maybe a seller throws in a credit to help the buyer pay points to lower their rate. Maybe you tap the shoulder of a friend that has a house you love. Of course, you need to avoid imprudent creativity, and hopefully, your advisor will help you to avoid this.

I also encourage you to mute social pressures – I give you permission to rent. Ownership is appropriate for long holding periods, but when your geographical permanence is in flux because of your family, career, etc., renting may be the prudent choice.

For sellers moving out of state, maybe have a multi-phased plan that starts with renting in your new zip code and/or renting out your current home. Give yourself a boomerang exit option. I’ve seen a lot of folks moving out of state (remember, I live in California), and sometimes a good idea or a dose of wanderlust can be fleeting. Sometimes the motivation of tax relief doesn’t live up to your expectations or kids/grandkids move, or whatever else might happen. Take my advice, retain flexibility; optionality is a beautiful thing.

A Home, Not a House

Ultimately, qualitative factors matter here – where does your family want to live, and what makes the most sense for your family? Obviously, always rooted in the financial sense of what is feasible, but you have to weigh these qualitative factors and take them seriously. For some of us, this is easy, for others – especially the frugal type, like myself – this can be hard. When I was single, I rented a room from my pastor, and he always used to try to move things into my room – a piece of art, a lamp, etc., because my room was so bare; spartan living. For that time of my life, that was ok, it was just me. That doesn’t fly for a family of four with a fifth on the way. Personal finance screams quantitative, optimal, maximize, etc. BUT we must remember that we save and accumulate to enjoy and share with the ones we love.

Again, I wrote this article to give you permission to transact. Obviously not something to be taken lightly and a conversation to have with your family and advisors, but I don’t want you to feel like you have to “wait until the market settles” or “time a better entry point.” I want you to be patient because patience yields benefits, but I don’t want you to defer because of anxieties or unfounded concerns.

Greed is what you can’t have now, regret is what you can’t have back. Don’t let fear and greed drive your financial plan. Lean into patience and flourish, my friends. I hope today’s discussion will nudge you to reopen that dialogue about your family’s dream home.