A Practitioner’s Perspective

I know I’m not the smartest guy you’ll ever meet.

And I know I don’t have a reputation or record of predicting macroeconomic events.

So why listen to what I have to say?

Well, I have a distinctive vantage point as an advisor – as a practitioner versus an academic – who talks to investors all day long, every day.

I know what makes investors tick. I advise folks to make wise financial decisions, and I know what fears and concerns are currently dominating their thought life.

Today we will discuss what I believe is the number one concern on most investors’ minds, and I’ll explain why you really shouldn’t be worried.

But first, let’s talk about Winnie The Pooh….

The Heffalump

As a father of a two-year-old and a three-year-old, I get a lot of exposure to children’s movies. My wife and I try to filter what our kiddos watch, and Winnie The Pooh is on the short list of approved entertainment. Innocent and wholesome stories of a little boy (Christopher Robin), his stuffed animals, and his vibrant imagination.

During one adventure, Winnie The Pooh and his friends are in search of a Heffalump. Pooh, Rabbit, and Tigger break out into song as they describe to the youngest of the bunch, Roo, how dangerous and scary Heffalumps are. In reality, Heffalumps are elephants and just as friendly as all the other animal characters in the show, but equipped with traps, ropes, and nets, Pooh and crew sing this little descriptor to Roo:

[Rabbit:] Everyone knows what a heffalump’s like

[Tigger:] It’s got fiery eyes and a tail with a spike

[Rabbit:] With claws on its paws that are sharp as a tack

[Tigger:] And wing-a-ma-things coming out of its back[Tigger:] ‘Cause its bottom is up and its top’s really down

[Rabbit:] So its nose is its tail or the other way ’round

[Tigger:] Yeah, and it’s wide as a river and tall as a tree

[Rabbit:] Imagine gigantic

[Tigger:] And times it by three[Rabbit:] It clomps here and there

[Tigger:] It stomps to and fro

[Rabbit:] It’s got three horns above

[Tigger:] And eleven below

[Piglet:] And those are its good points

[Winnie the Pooh:] There’s much more to know

[Chorus:] About the dreadfully dreaded

Thoroughly three-headed

Horribly hazardous Heffalumps[Rabbit:] Everyone knows that they lurk and they creep

[Tigger:] The best time to see one is when it’s asleep

[Rabbit:] If you sneak up behind it and get it to jump

[Tigger:] You can tell which part’s Heffa-hee-hee

[Rabbit:] And which part is lump[Chorus:] They’ll steal all your honey and eat your last crust

Stomp on your house till it’s nothing but dust

The worst part of all is

[Roo:] They’re different from us?[Chorus:] They’re the dreadfully dreaded

Thoroughly three-headed

Fiercely ferociously

Mostly atrociously

Horribly hazardous

Heffalumps!

In the movie, Roo splits up as he treks out in search of the infamous Heffalump. On his journey, he stumbles into a new friend who seems to be lost, Lumpy. Lumpy is a Heffalump and doesn’t fit the dreadful description that the elder statesmen of the Hundred Acre Woods had provided to Roo. Lumpy is kind and playful; Lumpy is a friend.

Here’s the takeaway:

Were Heffalumps (elephants) real? Yes.

Were Pooh and his friends afraid of the Heffalump? Yes.

Were Pooh and his friends going to experience/meet a Heffalump? Yes.

Were their fears and expectations accurate? No.

Recession Fears

An impending recession is the number one concern on investors’ minds right now. These concerns are causing an investor to alter their behavior, and these alterations are rooted in Heffalump-like fears. This recession hanging over investors’ heads is paralyzing and creating an excuse for many investors to derail their financial plans.

Today I am going to explain how the stock market, the bond market, and the economy have already shown that they expect a recession and why this is not something you should fear. Allow me to take you through the same line of questioning:

Are recessions real? Yes.

Are most investors afraid of a recession? Yes.

Is it likely that investors could experience a recession in the near future? Yes.

Are the most common fears and expectations surrounding a recession accurate? No.

To expand on this, let’s look at what stocks, bonds, and the economy are telling us.

The Predictive Power of the Stock Market

The Stock market is a…

Leading indicator.

This means that what is happening in the stock market today tells you something about the future. Stock prices are the net present value of future cash flows, so a significant dip in stock prices would lead one to believe that there are upcoming concerns for future cash flows or profits.

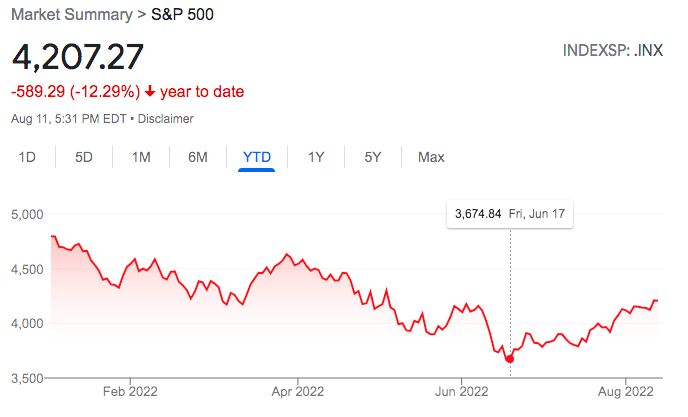

The stock market (S&P 500) lost nearly a quarter of its value in the first half of this year:

Source: Google

A nearly 25% drawdown is not normal behavior for the stock market – it’s not rare, but it’s not normal. When something is acting abnormally, it should draw our attention to lean in and ask questions. What is the stock market trying to tell us? One conclusion might be that a recession is coming.

Now, before you let your blood pressure rise and you begin to take that defensive posture, remember the first thing I said – the stock market is a leading indicator. The market has rebounded nearly 15% from the trough that was set in June.

I can’t tell you where the market goes from here, but if the market was signaling an upcoming recession, you’d be too late to react to that news now. You’d probably find yourself getting punched twice – experiencing the drawdown and missing the recovery.

The Bond Market Isn’t Shy

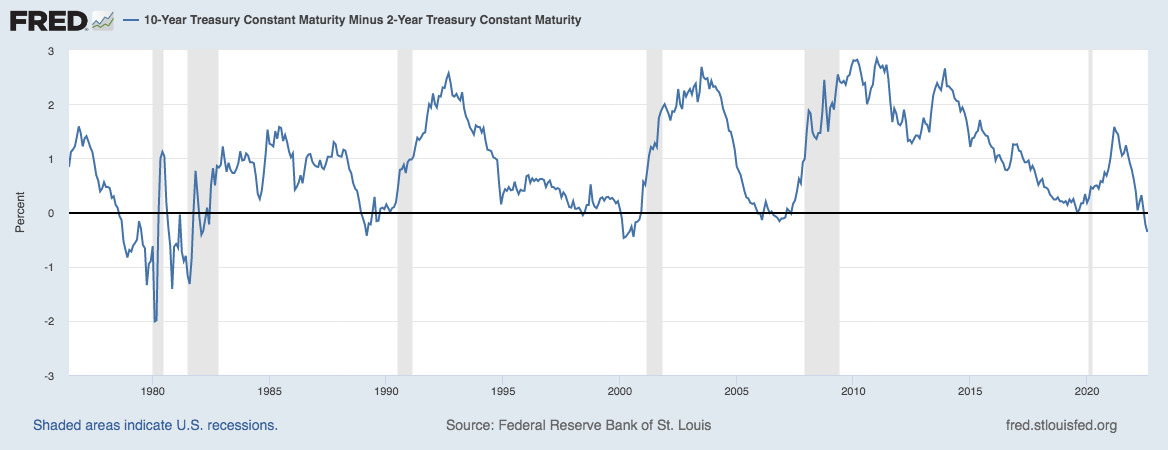

In that same vein of normal behavior, let’s talk about how bonds normally operate. Typically you get paid a higher interest rate the longer the maturity of the bond. Essentially, you’d assume that if you lend the US Government money, you would get paid a higher interest rate on a 2-year loan than on a 3-month loan, a higher rate on a 10-year note than a 2-year, and so on and so forth. When we plot out this spectrum of rates over different terms, we call it a yield curve – an upward slope of interest rates as the maturities get longer.

Currently, bonds are reflecting abnormal behavior. A 2-year Government bond pays a higher interest rate than a 10-year Government bond – we call this an inversion. This is not unheard of, it is just rare. Again, we lean into rare, and we investigate – we want to understand what exactly is going on.

Let’s translate into a statement what the bond market is telling you. The bond market feels like something is going to happen between that 2-year and 10-year period. That “something,” perhaps a recession, will most likely have an impact on rates. So, is it idiotic or insane to buy a 10-year bond when the 2-year rates are higher? No. Why? because when your 2-year bond matures, you are going to need to reinvest those proceeds somewhere, and the bond market is hinting that maybe that reinvestment won’t be as attractive as what the 10-year is offering you today.

An inversion can be a predictor of an upcoming recession. The chart below shows you the historical relationship between the 10-year bond and the 2-year bond. A dip below the black line represents those rare periods of inversion, and the grey shaded areas represent recessions. As you might notice, an inversion has been a leading indicator of recessions in the past. This is not a perfect predictor, as no single data point is, but it does show some persistence and accuracy, as you can see below:

Again, no reason to react to this news or this data point, as leading indicators mean that your fears have already been priced into the investments.

And The Economy

The most traditional definition of a recession is two consecutive quarters of negative GDP growth. If you are not aware, we’ve already checked that box. Now, according to the “rules,” you and I are not allowed to declare that we are in the midst of a recession, as that authority has been granted to the National Bureau of Economic Research (NBER).

NBER’s determination will not be a leading indicator, as their declaration will simply describe what has already happened, and this information will only be useful for the history books.

Needles to Say

I have a history of passing out from the site of blood and needles; I am quite sensitive to it. So, I often have to tell doctors to warn me when they are taking out a needle, and I have a routine of looking away and trying to self-create some distractions. Most doctors are really good, and they help by talking sports with me or asking questions about my family. Often they will say, “All done!” and I didn’t even realize I got the shot. For me, this is ideal. Yes, my fears of needles are obviously overblown, but my physical reactions are real, so the help and comfort of the professional here are welcomed.

Maybe recessions are to you what needles are to me. The good news is there is a good chance that Dr. NBER will announce “All Done.” while you are still white-knuckled and embracing for impact. As mentioned, if you’ve made it this far with the stock market and the bond market, perhaps you’ve already experienced the brunt of it.

Fear Itself

The point I wanted to get across today is that I think a lot of us have created this scary Heffalump-like fear around recessions. And furthermore, this fear has caused a lot of people to defer decision-making and derail their financial plans.

Again, if this is you, there is no need to be embarrassed; I’m the guy that’s afraid of a tiny needle, and the way my body reacts to needles is both comical and overdone. Yet, those reactions I have are real, and they feel paralyzing – so I get it.

Roosevelt said it best,

All we have to fear is fear itself.

He was exactly right. It’s not the Heffalump, it’s not the needle, it’s not the recession, it’s the narrative that we create and the fear we feed that causes us the most harm.