What an odd title for an article, right? At first glance, it seems like an oxymoron. Can you really pair those two words together, “prudent” and “debt?”

The word debt comes with a lot of strings attached; debt carries a lot of negative connotations.

Traditionally maybe you’ve associated leverage or borrowing or debt with words like risky, bankruptcy, margin calls, etc. These associations come from the dangers of leverage, which is why prudence is so vital. Today, I want to teach you why I associate leverage (synonymous with debt) with the word “exposure” and how I see this as the primary benefit if handled prudently.

On Fiya!

Words like burned, destroyed, fatal all represent the dangers of fire. Yet we know words like warmth, baking, or fireplace can also be words that reflect the benefits of fire. If we played that same word association game with the word “fire,” we could create a similar dichotomy.

Like so much in the world of finance – framing is key. We must reframe or rethink or challenge our views around debt for some of us.

I think it is appropriate to state the obvious – these concerns or fears around debt are well deserved. Debt can be dangerous and can create serious damage, just as fire can. In 1998 the Federal Reserve had to coordinate a bailout in the tune of $3.6 billion for a hedge fund, Long-Term Capital Management, that experienced the fatal dangers of excessive leverage. Just Last year, Bill Hwang overseeing Archegos Capital Management became the headline story for his imprudent use of leverage and the collateral damage this created for the likes of Credit Suisse, Goldman Sachs, and Morgan Stanley. The reality is, you don’t really need to search headline news or financial history to extract these anecdotes. I’m sure you have a friend or family member that has endured bankruptcy or foreclosure.

Getting The Right Exposure

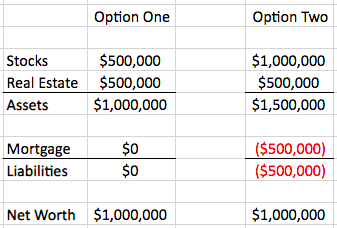

Now, let’s pivot and discuss what I mean by “exposure” and how this is the best way to frame our discussion around debt. We will start simple; I want you to imagine a balance sheet. A balance sheet is made up of two parts: assets and liabilities. For our imaginary balance sheet, let’s say that our fictional investor has $1,000,000 in stocks and no debt. That is to say, $1,000,000 in assets and $0 of liabilities. Now, our imaginary investor decides they’d like to purchase a $500,000 home. Let’s layout two options. Option one, sell $500,000 of stock and use the cash proceeds to buy the home. Option two, borrow $500,000 to purchase the home, adding a $500,000 mortgage (liability) to the balance sheet.

For illustrative purposes only

Both options produce an identical net worth on day one, but the key difference is that option two retains a greater exposure to stocks. This additional exposure, if excessive, can create real problems, it can be a real danger, but if managed prudently, this increased exposure can also generate real monetary benefits.

There is another key detail about our hypothetical. The debt being resourced was being used to acquire an asset. When determining whether the use of leverage is prudent, it is always important to look at the use case. Our hypothetical investor didn’t go out and finance a fancy vacation or acquire an expensive toy. The use of the leverage was investment-related as opposed to consumption-related. Most prudent uses of debt are used for the acquisition of an asset or to amortize an expense (e.g., student loans or stretching the expense of a large tax payment).

This concept of exposure is key because so much of the benefits of investing are about creating investment exposures and allowing them to compound (grow) uninterrupted for decades. If more significant exposures can be created and managed within the realm of prudence, then these benefits can compound, making meaningful improvements on long-term outcomes.

Counting The Costs

Now, let’s build on this further. Pension funds, like Calpers that have defined liabilities (pension payments) in a world where folks are living longer and expected return expectations, are below the historical average; prudent ways of creating more exposure are needed. In order for these elevated exposures to create a benefit, one must believe that the cost of borrowing is less than the expected return generated from the asset acquired or retained. This is something that should be measured, challenged, researched, and well thought out. As I’ve mentioned many times on this blog, the current interest rate environment we find ourselves in is very friendly to borrowers and punishing to cash savers. Low-interest rates create a meager hurdle rate for the expected return on your assets. Headlines like this from the Wall Street Journal, “Retirement Fund Giant Calpers Votes to Use Leverage, More Alternative Assets,” are understandable based on this interest rate environment.

Importantly though, here is what I am not saying. I am not saying that you should go out and take on debt or lever up your investment accounts. Just like I don’t think you should go out and light fireworks in a dry forest. The goal is to study your balance sheet and ask questions to decipher whether it is optimally designed to meet the objectives of your financial plan. Sometimes leverage isn’t even about adding any liabilities to your balance sheet. Sometimes just opening a Home Equity Line of Credit or a Portfolio Line of Credit to create a safety net or backstop can allow you to recraft your asset allocation and increase your exposures to assets with higher expected returns.

“The first rule of compounding is to never interrupt it unnecessarily.” – Charlie Munger

Investing is simple and complex at the same time. The simple part is to save, invest, and let it compound – the investments do all the heavy lifting. The tricky part is not to disrupt the compounding. The prudent use of leverage can help you not disrupt compounding and sometimes even increase your exposures accelerating the process.

As we’ve analogized throughout this discussion, leverage is also highly flammable. So, this discussion has to be accompanied with a disclaimer, “Don’t try this at home,” or perhaps better said, “Don’t try this outside the supervision of a financial professional.”

If you want to discuss further, or if this article sparks any questions or comments, feel free to contact me at .