Here is a very common question I get as an advisor, “Should I pay off my mortgage?”

This is a difficult question to answer for two reasons:

- Most of the people asking have already come to their own conclusion, and they’d be hard-pressed to be convinced otherwise. They are looking for confirmation rather than insight.

- The answer to this question depends on the particulars of one’s situation, this is not a quick and easy, black and white, yes or no answer. Some significant discussion and financial planning needs to come first.

Which makes this the perfect question to address on TOM.

In today’s article, I’d encourage you to pay close attention to the step by step process for how we come to a conclusion. The greatest lesson from our discussion will not be the actual conclusion, but rather the thought process leading up to it. Learning to be a better “financial thinker” and how to better construct an assessment for these types of questions are the primary goals.

And off we go…

Stubborn as a Mule

During John Adams’ Boston Massacre defense argument, he eloquently stated, “Facts are stubborn things; and whatever may be our wishes, our inclinations, or the dictates of our passions, they cannot alter the state of facts and evidence.”

I love this quote because it reminds me that facts are stubborn, but I shouldn’t be. Much of financial planning is fact-driven, evidence-based, and can be quantified and compared. Yes, our emotions do play a factor and should always be considered, but the point is that it’s easy to create a side by side comparison to measure different options against each other. This allows us to separate opinion from fact.

I start with this because many of us will immediately jump to our own conclusion with this question, “Should I pay off my mortgage?” And we will often do so without any comparison or any preliminary due diligence. We will be convinced about the superiority of one option over the other without providing much reasoning for thinking so.

Moral of the story – don’t be stubborn.

Cash Flow vs. Net Worth

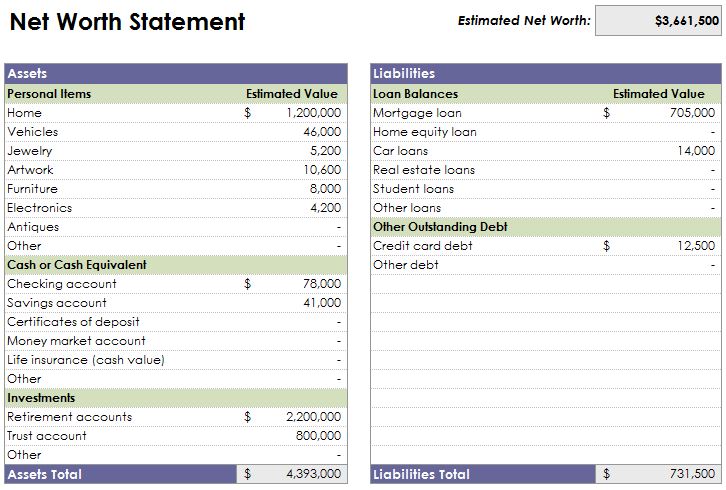

To answer this question, we first need to have a basic understanding of the difference between net worth and cash flow. So, here is a simple explanation. A net worth statement is an itemized list of one’s assets and liabilities (debts) that provides a total value of their net worth at a particular point in time. It may look something like this:

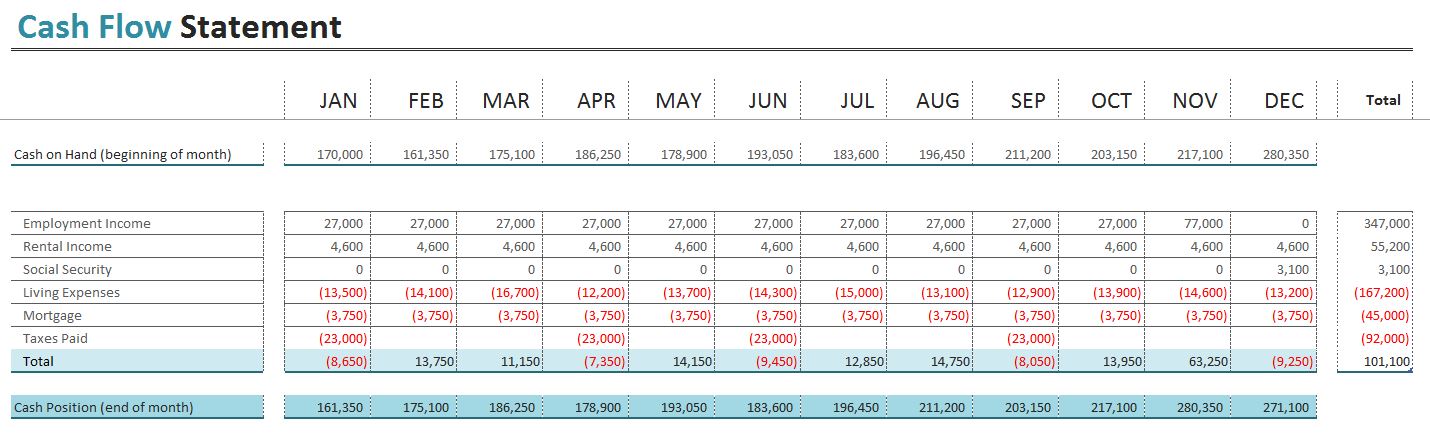

A cash flow statement, on the other hand, will illustrate all of one’s income and expenses provided in a single snapshot for a given time period. Which may look something like this:

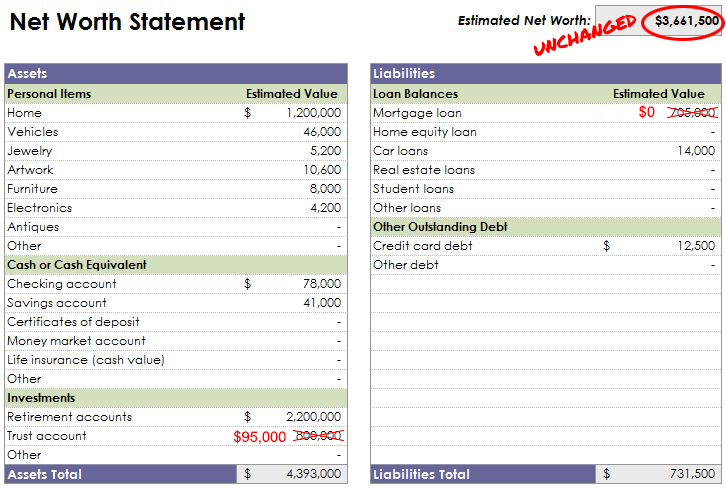

So, if you are to pay off your mortgage, what effect would that have on your net worth? What effect would that have on your cash flow? Your net worth would not change. For our example above, you could use the funds from the trust account to pay off the mortgage loan and this is what that would look like:

As you can see, the estimated net worth was unchanged. As for cash flow, we would see a difference because the monthly mortgage expense would be eliminated therefore the net cash flow total would increase.

So, although this may seem simplistic, let’s recap. When the mortgage was paid off, we just shifted the balances on the net worth statement from one side to the other by using an asset (trust account) to pay off a liability (mortgage loan). And this resulted in improved monthly cash flow. Easy to understand, right?

Interest Expense vs. Interest Earned

If we stopped the conversation there, it would seem like a no brainer to always pay off the mortgage. Net worth was unchanged and cash flow improved, sounds like a win-win, right?

Here’s the next factor that needs to be considered. We need to understand the difference between an interest expense and interest earned. Or said another way, we need to understand the difference between the cost (interest expense) of our mortgage and the expected return (interest earned) on our investments.

Before we dive deeper into this, let’s back up a little bit and answer this question first, why does one take out a mortgage? Or any debt for that matter? The obvious answer would be that we want to enjoy something today (a home, a vehicle, a television, etc.) that we can’t fully afford to pay for today. By stretching out an expense over a specified time period we are able to afford it by paying for it over time.

Ok, that makes sense, but then why do people or companies take out debt for things that they can afford to pay for today? Why would a company like Apple who has nearly $100 billion more in cash than debt borrow more money in 2019? It’s simple, this is done because one believes that the expected return on their investments will be greater than the interest expense of their debt.

So, now back to our mortgage conversation. Before we decide to keep the mortgage or pay it off, we need to understand how much it costs. This is actually an easy figure to obtain, you can inquire with your lender or just resource many of the free online mortgage calculators available.

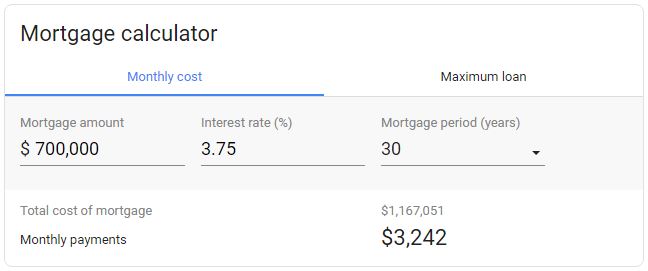

Here’s what that might look like for a new mortgage:

In this example, the amount borrowed is $700,000 and the total cost of the mortgage is $1,167,051. The interest expense over the life of the loan will be the difference between those two figures, $1,167,051 minus $700,000 which is $467,051.

So, if one was to justify holding onto this mortgage (meaning they had enough available resources to pay it off if they wanted) then they’d need to believe that they were going to earn a greater return than that $467,051 over those 30 years. Again, facts are stubborn, this math can be computed, options can be compared, and you can come to a sound conclusion.

Interest Expense is not Linear

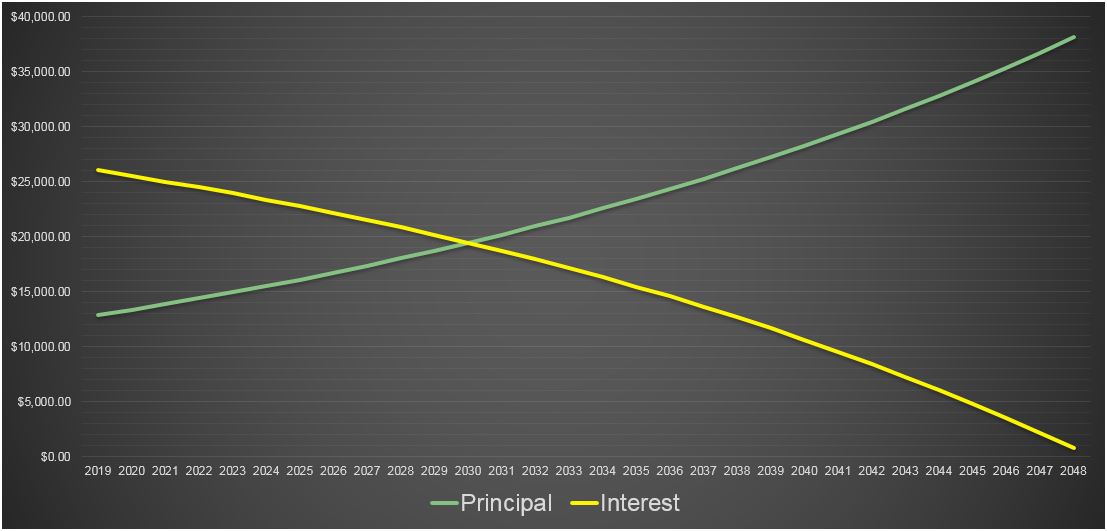

Next, we need to know and understand how the amortization schedule on a mortgage works. A traditional fixed-rate mortgage has a fixed monthly payment for a certain term. For the screenshot we provided above, $700,000 was borrowed at 3.75% and the monthly payment is $3,242 each month over the life of the loan. Now, although the monthly payment is fixed, the portion that is allocated to principal vs. interest is changing each month. Over time the interest payments are shrinking, and the principal payments are growing. Here’s what that looks like graphically:

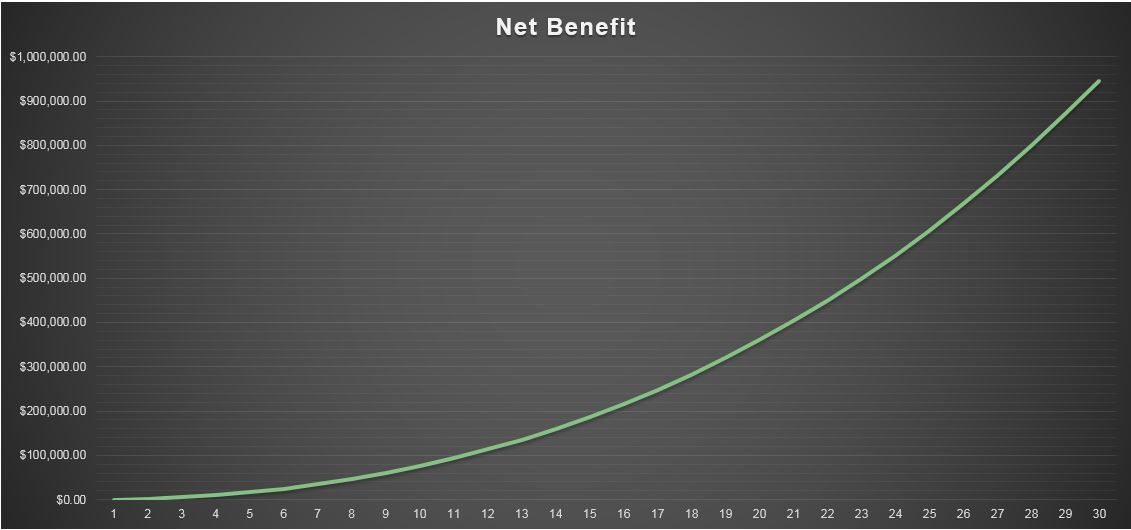

To provide a comparison, let’s model out what a 3.75% fixed return would look like compared to the interest expense graphed above. We are making this comparison because we want to see the outcome of paying off the mortgage vs. keeping the mortgage and investing the balance.

As you can see, the gap between interest earned and the interest paid (expense) is growing over time in this illustration. This might be surprising, seeing that we are comparing a mortgage at 3.75% and an investment with a fixed 3.75% return, but remember that the interest payments are shrinking as the principal payments are reducing the loan. That little fact, which could be easily overlooked, is what is driving the benefits of keeping the mortgage in this illustration. Here is what that benefit looks like over the life of the loan:

The benefit of keeping the mortgage and investing the balance for our hypothetical was almost $1,000,000. Keep in mind that we assumed a fixed rate of return and we assumed that it stayed invested over the life of the loan. To create your own comparison, you will need to use assumptions that are appropriate for your situation.

Understanding Liquidity & Tax Benefits

So far, we have covered what I would describe as the meat and potatoes of this conversation. I did want to add a few extra considerations though, as I do believe these factors should play into your decision.

Liquidity is a word we use in finance to describe how easily an investment (stocks, bonds, real estate, etc.) can be sold and converted into cash. Things like government treasuries (bonds issued by the US government) are an example of an investment instrument that is extremely liquid. If you wanted to sell a government treasury that you own, you could convert it to cash quickly and cost-efficiently. Real estate, on the other hand, has a much different liquidity profile. If you wanted to convert a home you owned into cash, what would the process be? You’d put the home on the market, wait for a buyer to make an offer, go through the negotiation process, then move onto closing. Unlike a government treasury bond, which you might sell with a quick click of a button, the home selling process is time-consuming and costly.

This is important to know because a decision to pay off a mortgage means that you are also changing the liquidity profile of your own balance sheet. Additionally, if you were not interested in selling your home but you did want to access the equity, this would open up another slew of options that may not be as favorable as a mortgage. Things like home equity loans, reverse mortgages, cash-out refinances, etc.

Beyond liquidity, we also need to factor in the tax benefits of having a mortgage. For some, the deductibility of the mortgage interest could provide an added tax benefit. This tax benefit could be real dollars and cents savings that would be forfeited if the mortgage was paid off. This won’t apply to everyone, but again these are the type of additional considerations that need to be accounted for.

Opportunity Cost

We will close out our discussion with this one final tidbit that is often overlooked.

Opportunity cost is a term we use to describe the potential benefit that is lost by making one decision compared to another. As humans, we are very good at recognizing the costs/expenses that are obvious and apparent, the ones that we look at every day. Most of us dread writing that check to pay our monthly mortgage payment and we feel burdened by the thought that we have an owed balance floating around out there. It’s these types of emotions that are usually the driving force behind our decision making.

Here’s my question for you though, what about the opportunity cost? Have you considered what the potential benefits are that you may be giving up? This is not meant to be an article advocating for keeping your mortgage, again it all depends on your particular situation. But, just as an example, in our hypothetical we gave above there was this potential opportunity cost of approximately $1,000,000. That cost would never be considered or realized if the frontend work of mapping out our decision was never completed. This is why I emphasize this idea of learning how to think.

That’s It

And that is all I have for you today. I hope you enjoyed today’s discussion and I hope it was helpful. I think conversations like this can be very educational and they also reveal the importance of partnering with the right professional to help sift through these tough financial decisions. Personal finance does have a certain level of complexity to it and it’s almost unavoidable, but with a good plan in place and a trusted advisor, it makes the path to success a bit easier.

Until next time, this is TOM signing off…