I live in San Clemente, California. Also known as The Spanish Village By The Sea. A wonderful place to live, if you ask me.

The city has two claims to fame:

- The Western White House, the former residence of Mr. Richard Nixon, is in San Clemente

- San Clemente has the worlds best climate

I am not sure what report or survey substantiates claim number two, but the town is littered with license plate frames that flaunt “best weather in the world.” The city’s website, www.san-clemente.org, states, “The city boasts “the world’s best climate” as San Clemente enjoys roughly 300 days of sunshine per year and an average annual temperature of 73°.”

Our family takes full advantage of this beautiful weather, and I am sure these claimed averages do ring true, but this does not stop us from checking the weather forecast on a daily or weekly basis. Whether we are making a trip to the local zoo, planning a beach day, or having a picnic with friends, we’d like to know the specifics of what the weather will be like.

We need to know if we should pack jackets for our two boys or if we should wear shorts or on the rare occasion that it would be wise to bring an umbrella. We don’t prepare for an outing based on the “average” weather; we plan according to the day’s actual weather.

I know the statement above is both obvious and silly, but when it comes to inflation, people often prepare and fear the “average,” but are unaware of the actual. Today we will discuss why inflation is a very personal matter and how one’s financial plan should address their personal inflation expectations.

A Hot Topic

Financial news is a revolving door of “hot topics.” These are the subject du jour that every media outlet is covering. One of those popular discussion items right now is inflation. With the recent government stimulus (and more to come), there is growing chatter and fear that inflation is coming.

David Bahnsen has written extensively about our country’s deflationary pressures and the counterarguments to consensus opinions around these inflation concerns. I’d encourage you to read the two-part series he crafted on the subject in January:

THE GREAT DEBATE – DIVIDEND CAFE – JAN. 15

THE GREAT DEBATE PART 2 – DIVIDEND CAFE – JAN. 22

Here on TOM, we will avoid the macro discussion surrounding the forces that cause inflation and our forecasts/expectations for such. In a recent exchange between David Bahnsen and Larry Kudlow on Fox Business, Kudlow said it this way,

“I don’t think the Fed really knows the causes of inflation. No matter what the fed wants with higher inflation or maybe someday lower inflation, I don’t think they have the foggiest idea of how to do it. All the models have broken down…”

With that said, we will reserve those discussions for the academics. I’d like to discuss the practical implication of inflation on your financial plan with you today.

Let’s Start Simple…

First, we will define inflation. Let’s keep it very simple. The goods and services that you purchase become more expensive over time. Meaning that your money can buy fewer goods and services tomorrow than it could buy with the same dollars yesterday. Typically, these increases are small, almost unnoticeable, but recognizable in hindsight as they compound over time.

A 3% inflation rate means that expenses would double every 24 years. This seems harmless, but it can become significant over a lifetime, which is why it is such an important factor to consider when crafting a financial plan.

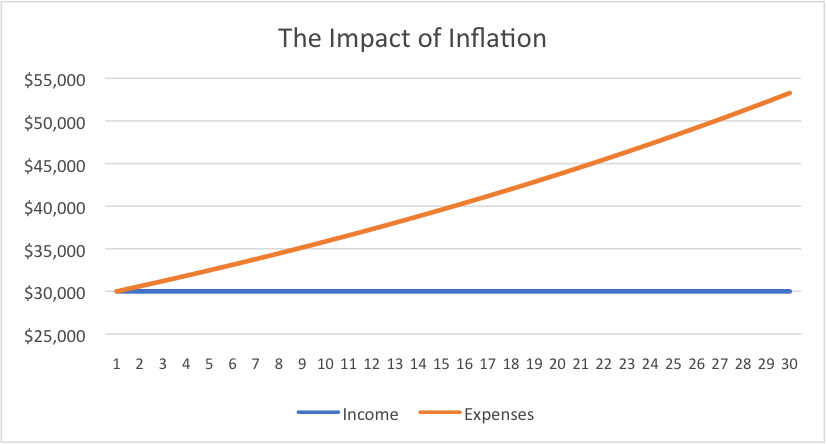

Let’s layout a very simple hypothetical. Imagine if you had million dollars saved and you needed to generate $30,000 a year to cover your expenses. So, you buy a CD that pays a 3% interest rate, and over the next 30 years, inflation is 2%. Here’s what that would look like:

So, the investment you bought on day one was satisfying your income needs, but 30 years later, it was only covering a little more than half of your expenses.

Again, not obvious on day one or perhaps even year two or three, but the gap widens and compounds significantly over time. This is why the type of investment you own and the expectations around income and growth of income are so important to your financial plan.

What you think might be a conservative choice today may have some unintended embedded risks of falling short in the future.

Actual Over Average

Much of the discussion around inflation happening right now is based on average expectations. Inflation is often referred to in metrics that bundle together average prices of multiples goods and services over multiple geographies. These averages are used for things like setting the cost of living adjustments on social security.

Here’s one issue with averages, the underlying constituents can widely vary from the average. An average 3% inflation might capture deflation in technology (e.g., the price of a television today vs. 20 years ago) and an exaggerated spike in healthcare or education. This means that your personal inflation rate will depend a lot on your personal spending habits.

Do you have a child in college? This might hike up your personal inflation.

Are you healthy and rarely need medical attention? This might reduce your personal inflation.

Again, you don’t prepare for the average weather; you dress according to the actual weather.

Calculating Your Personal Inflation

The title of this segment may scare you away. It sounds like a daunting calculation, right? Well, there isn’t really much you will need to calculate. Let me explain…

The very first Thoughts On Money article was titled Be Aware or Beware. This discussion advocated for spending awareness. I know how hard budgeting can be to stick to the budgets and track the categories. My encouragement is for all investors to just know one very simple metric each month – what was your total spending for the month? Not your estimate, not your best guess, what you actually spent. What showed up on your credit card statement, and what money left your checking account?

If you know how much you spend each month, then you will know how much you spend each year, and you can easily see what your personal inflation percentage is. Will this capture some lifestyle creep? Of course, this number will show any increase in spending, whether those are one-off expenses or a basic rise in your lifestyle. But guess what? Your financial plan doesn’t care if it is inflation or an upgraded lifestyle – spending is spending. The goal of the financial plan is to capture an idea of what that general rate of change is and be able to apply it to the future.

Here’s an interesting anecdote. I’ve been a faithful know-what-I-spend-each-month investor for many years. I find that it helps me keep a pulse on our finances, and the awareness helps to drive good financial behaviors. Well, during the COVID moment, I sort of took a break, I was disconnected for about 4 or 5 months. When I went back and updated my tracking my reviewing credit card statements, I was surprised to see that my spending had decreased by more than 20% a month while everything was shutdown. Again, not a significant sample size, this was just my spending, but I started to wonder what impact that would have across our economy as I am sure this truth applied to most Americans.

I can’t express to you emphatically enough how important this part of financial hygiene is – if you don’t know what you spent last month or the month before and so on, you are absolutely flying blind.

Practical Application

Sometimes with topics like inflation, it can feel more theoretical than practical, and we lose sight of how this knowledge or awareness should impact the way we approach our investments and financial plan.

Here are the two takeaways that I would encourage you to walk away with from today’s discussion:

- Review your portfolio with your advisor, get a clear understanding of what the long-term expected returns should be based on the design of the portfolio, and how this stacks up against inflation – an inflation-adjusted return that is negative will not suffice.

- Create a system for notating your totally monthly expenses – this can be on excel, using an online expense tracking tool, or even written in a personal journal – periodically review these figures to understand your personal spending trends over time.

So much of financial success revolves around your awareness and your ability to create and execute a simple financial plan. I hope our discussion today provided you with a greater awareness of how inflation personally impacts you as an investor and some tools and resource for how you can plan to combat this inflation reality.

Please come back next week, as I plan to share more of my Thoughts On Money.