Dear Valued Clients and Friends,

I really want to thank those who expressed kind sentiments about both of my recent two-part series in the Dividend Cafe. The “great debate” series on inflation/deflation seemed to generate a lot of interest, and I think the “Tom Brady” issue last week on the dilemma of growth/value identification in 2021 was one of the most commented-on commentaries I can remember writing.

I do some fun things today in the Dividend Cafe. We dive deep into the dilemma facing income investors, those who want and need cash flow from their portfolio. It is a conversation that can (and does) go in a number of different directions. I hope you find it riveting.

And we talk a bit about bubbles, about history, about market fads and market risk …

And of course, we look at the present economy and make some bets on where things are going. I hope it will prove informative for you.

A lot of topics that somehow are all loosely connected to one another, in this week’s Dividend Cafe.

The Great Income Dilemma

One of the “takeaways” or conclusions in the two-part series I concluded last week was that dividend growth investing was the most sensible solution I have found to the “tension” many find between concerns about so-called “growth” investing (i.e., excess valuations that make entry point incredibly risky) and so-called “value” investing (i.e., distinguishing companies at a compelling value from companies who have earned their low valuation in a so-called value trap). It is fair to say that the dividend growth solution for a wide array of reasons is one of the great passions of my life, and I will spend the rest of my career being an evangelist for it, and practitioner of it.

It is interesting to note a dynamic that has played out since the COVID moment began approximately one year ago, and in this dynamic, I would like to make another point about dividend growth investing.

When the pandemic struck, the initial response was that stock market index yields went up as markets tanked, and the long bond yield tanked as money flew into treasuries. That all makes a ton of sense. One could buy the market index at a 2.4% yield when it had been just below 2%, for no reason other than that the S&P 500 had just gotten done dropping 36% in a month. And at the same time, the 30-year dropped to 1% for a brief moment, and the 10-year dropped to 0.5% as money flooded into Treasuries in this great risk-off panic moment.

But note something else in the chart above. We know that the story of 2020 did not end with the panic sell-off of March 2020. Equities recovered at a surprising rate and to a surprising magnitude, and the yield now sits at an astonishingly low 1.46%. There has been muzzled dividend growth in the index; last year, there were a lot of dividend cuts and suspensions, but primarily market prices just went up a lot, which pushed the dividend yield way down.

At the same time, the 30-year Treasury has seen its yield “recover” – but only to 1.94%. It entered 2020 at 2.5%, and it spent most of 2019 at 3%, it spent of 2012-2018 around 3.5%, and obviously, we know pre-GFC it had been much, much higher than that. But for my point here, forget the long term change in 30-year bond yields. Even in the COVID and post-COVID moment, we are looking at bond yields between 1 and 2% (10-year around 1%; the 30-year trying to get back to 2%). And we are looking at a stock yield that is less than 1.5%, and would take a 25% drop in the S&P 500 just to get back to a 2% yield!

I understand that not all investors seek to withdraw current cash flow, and right now, my point is not about dividend growth as an accumulation strategy (though I would make that argument, too, morning, day, and night). But just from a pure income withdrawal standpoint – those who need and want current cash flow – pre-COVID, during COVID, and now post-COVID – we have settled into a world of about 1.5% whether you go into stocks or bonds.

I repeat. We have settled into a world of about 1.5%, whether you go into stocks or bonds.

What are you offering?

I believe that investors can find 4-6% yields in this world, and there is a combination of places to do it from. I also believe that they are wise to incorporate all options (from a pure diversification standpoint), and yet only one offers the combination of liquidity, tax efficiency, upside growth, and continual growth of income – all at once.

I am confident yields of 4-6% are available in Credit. Whether it be Structured Credit, High Yield, or Leveraged Loans, these “bond” instruments (they have a maturity date) require more risk and more volatility, but they do pay you for that risk.

My own read is that High Yield bond yields (i.e., junk bonds) do not pay anywhere near the yield level that would normally be required to compensate you for their risk, but we do not live in normal times. Those who have followed the great Michael Milken offer their thanks to Chairman Powell (meaning, the Fed’s shocking direct support of the high yield market last year was one of the most unexpected developments of the 2020 year).

Similar to the high yield corporate market, the traded bank loan market offers compelling yields with various rate protections: higher price volatility, but higher income.

And as I have written extensively, Structured Credit has shown to be the most extended recoveries of the post-COVID risk asset world. It was perhaps the most dislocated during COVID, and it has taken the longest to recover (and I assure you, I am NOT complaining about this!). The yields in non-agency residential mortgages, certain asset-backed securities, commercial mortgages, etc., have been (and are) quite enticing, even as prices have continually moved higher from their distressed prices of Q2 2020.

Bottom line: Credit offers 4-6% yields, with risk and volatility, a fixed price at maturity, ordinary income tax rates, high liquidity, and a fixed level of income. I like it as a complementary asset class for income investors.

And I certainly believe there are ample ways to generate optimal yield in the alternatives space. From real estate to private credit to middle markets lending to long/short credit to opportunistic structured, there are more cash flow generative vehicles in the alternative space than there have ever been. The goal here is to give up something (in this case, a lot of the beta of the equity and fixed income asset classes, as well as some degree of liquidity) in exchange for what can be picked up (in this case, low correlation to traditional asset class volatility and a diversified income stream).

Bottom line: Alternatives can offer 4-6% yields (or higher), with a non-correlated risk and volatility, more in line with manager risk than market risk, upside price potential, mostly ordinary income tax rates, limited liquidity, and generally pretty level income. I like it as a complementary asset class for income investors.

And then this brings me to dividend growth. Again, right now, in this context, I bring it up for that investor who wants current cash flow and finds the present equity market yield and bond yield inadequate (woefully inadequate) for their income needs. The nature of the underlying companies, where they stand in terms of book value, discounted cash flow value, growth trajectories, market momentum indicators, and all the other factors we talked about last week (all of which I believe are arguments for dividend growth equities right now, relative to other options in the equity market) – all of those things are outside the scope of this paragraph.

Instead, I would merely point out that a diversified, well-managed portfolio of 20-25 dividend growth names can offer roughly 3x the S&P market yield and roughly 4x the 10-year treasury bond level right now. It can do so while adding 5-8% in income next year, and the year after that, and the year after that, etc. It can do so with tax rates at 15-20% vs. 37% ordinary income. And it can do so with the underlying instruments also offering unlimited upside. The investments are not merely speculative because they are real operating companies with real free cash flows. And it can do so with daily liquidity.

Of course, the equity portfolio to which I refer is subject to equity market volatility. There is no free lunch (someone should write a book), but the combination of upsides to which I refer more than rationalize the elements that provide this risk premium.

Bottom line: While complementing dividend growth with Credit and Alternatives is a smart move for income investors looking to achieve some diversification and non-correlation in their portfolio, the core income strategy one should build their portfolio around is dividend growth stocks. The yields are superlative, the income from the portfolio grows, the underlying assets grow, the tax efficiency is high, and the liquidity is high. And equity volatility can be managed with diversifying asset classes around it.

Calling all contrarians

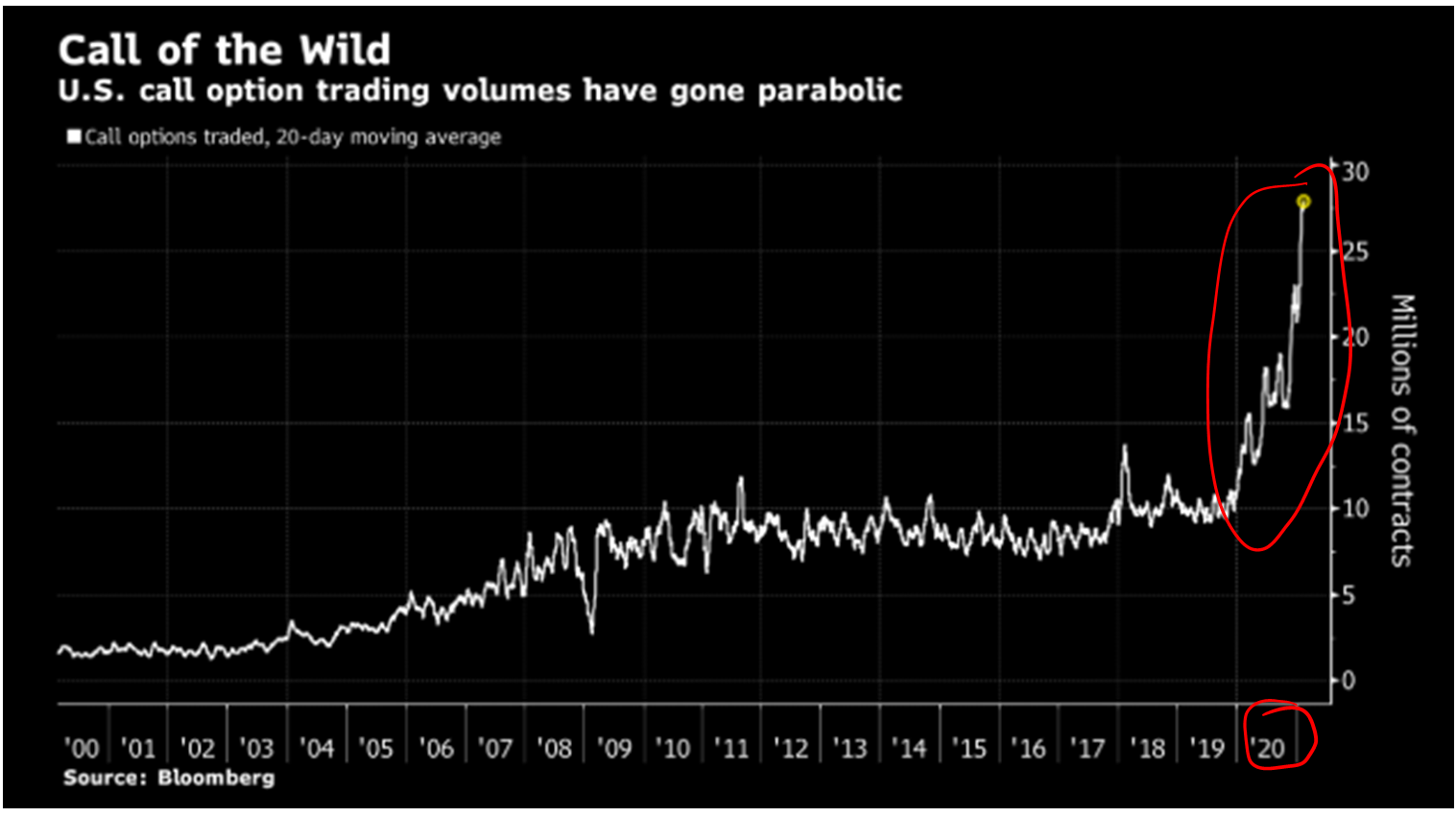

I just got this chart this morning as I was preparing to hit “submit,” but felt it needed to be incorporated into today’s commentary.

*The Boock Report, Bloomberg, Feb. 12, 2021

Call options are derivatives bought to bet on something going higher in price within a certain time period. This chart is capturing the total volume across all call options – so this includes index contracts (the most common) and individual securities. Look, a lot of money has gone into “betting” on certain risk assets going up in price over the last six months. A lot.

Counter-point

The forward P/E ratio of the fifty largest companies in the S&P 500 right now is 23.6x -expensive, above average, all of that. But in March of 2000, just to provide all accurate comparative data since this theme comes up so much, the forward multiple on the fifty largest companies in the S&P 500 was 31x. That is not an argument for the relative cheapness of the current mega-cap names; it is just a reminder that very expensive assets can get very, very expensive sometimes – timing is not usually feasible with these sorts of things.

Living in fear

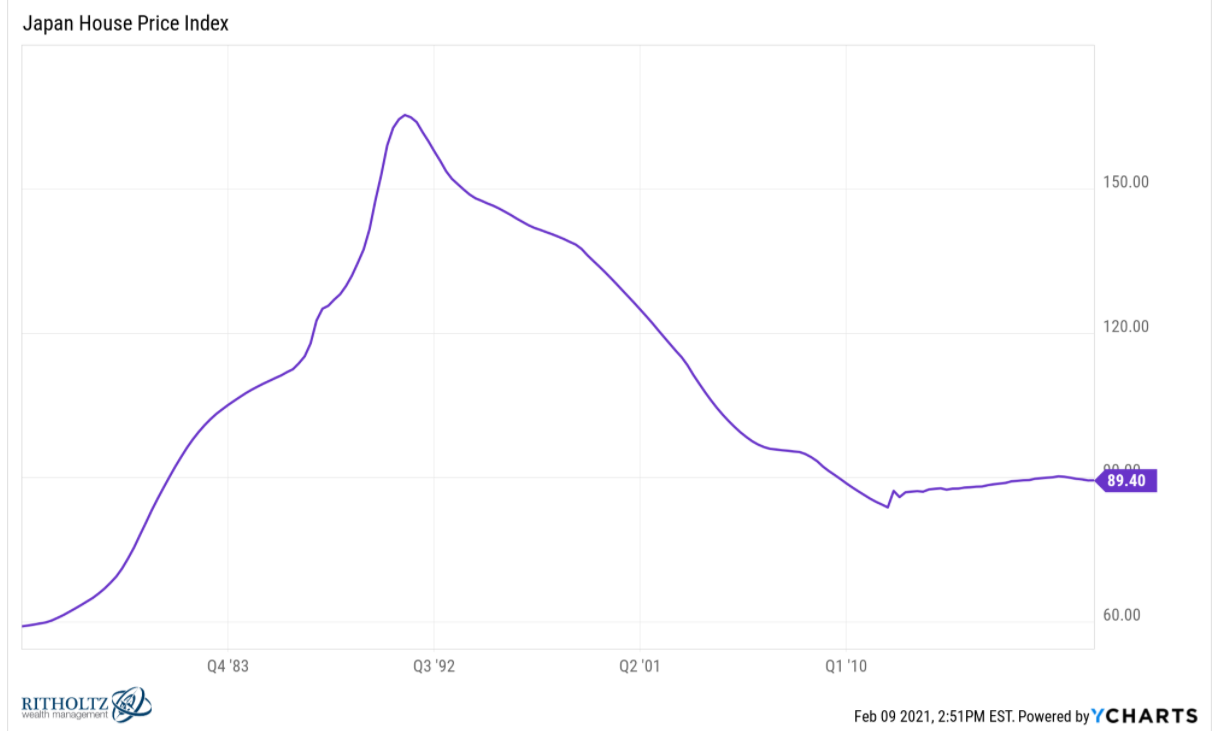

Nevertheless, the study of bubbles and manias is one I have devoted myself to for a long time. I am actually really grateful for a lot of the work done on the subject already that has helped fuel my study. One thing I know that always, always, always coincides with an asset bubble where prices become totally disconnected from reality – rationalizations as to why this time it is different. There would never be a bubble without such because apart from people’s ability to talk themselves into some rational defense of irrationality, the price elevations would stay contained. Study what was said about Japanese real estate in 1989; I promise you no one believed that housing would go down 50% in value; stay down 50% to this day!!!!!!!!

Dotcom 1999. Florida condos 2006. Pre-IPO unicorns 2018. And so many more before this century I can’t even count. Prices become disconnected from reality all the time, and it happens not because humans are stupid but because humans are susceptible. What are they susceptible to? They are susceptible to various lies that coincide with their hopes. The lies are things like “valuations don’t matter,” and “profits don’t matter,” and “this time it’s different.”

And after all those things happen and prices supersede the initial reality hurdle, then the greatest flaw in human nature comes out – fear of missing out. The “I have to participate because I can’t stand hearing my friend brag about it any more” fallacy. Somewhere after that and the next TV commercial running, asset manager putting a bubble-ready product out, chat rooms flowing, and bartenders talking (pre-COVID?), then we are ready. Then we know. Rinse and repeat.

I am not here to identify bubbles, and I am not here to time bubbles. I am here to proactively invest in a philosophy I believe in, one that was tailored to avoid the downside of bubbles by also avoiding the upside of bubbles. To that end, we work.

Not all high performers are bubbles

Commodity prices outside of energy are at five-year highs. No one could consider their pricing “bubble-like” though in a reflationary environment.

As we talked about a few weeks ago, Emerging Markets have exceeded U.S. markets all of a sudden in recent short-term performance. But by pulling the window back, we see a 10-year record where EM is many percentage points behind the S&P, still at heavy discounts to value.

Private equity has delivered stellar returns for many years. But is private equity an “asset class,” or just the home of new companies, new ideas, and new opportunities?

I am not bearish on risk. I am not bearish on investing. I am just trying to create distinctions in this environment between popularity and value; between risk and irrationality; between a plan and a hope. That’s all. I hope you can appreciate that that really is my job – my duty.

Cash Hoard?

There are $1.5 trillion more personal savings in the United States than there was a year ago. Mortgage cash out re-financings? Government stimulus? Extra cushion? Pent up demand from vacations and toys denied in this COVID moment? All of the above? The fact of the matter is, Americans are bad at holding on to savings. Personally, I like to see high savings levels because they cushion against future recession risk. But the fact of the matter is, when I see elevated savings levels, I always know one thing – a lot of money is about to get spent.

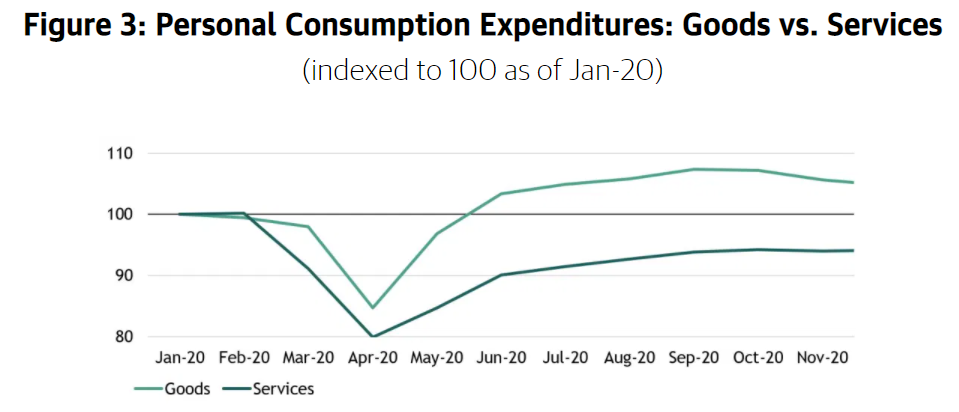

What’s a cash-heavy pandemic-fatigued person likely to buy? Hmmmm …

We can see in the data, clear as can be, where the cuts were when the pandemic began and where the recovery and restoration levels lie. The U.S. consumer got back to buying goods as quickly as they could after the initial pandemic peak in spring 2020. Services have stayed constricted. It is not my bet they will stay such for long.

Blackstone, Joe Zidle, Feb. 5, 2021

Blackstone, Joe Zidle, Feb. 5, 2021

By the way, some really respected economists disagree with me on this, including some I am very close friends with. You can find plenty of credible people who argue the pent-up demand for services thesis is wrong, that people will live in skepticism and fear long after the vaccine is penetrated, etc.

I simply disagree. History tells me differently. The data tells me differently. My anecdotal observations tell me differently. My beliefs about the American DNA tell me differently.

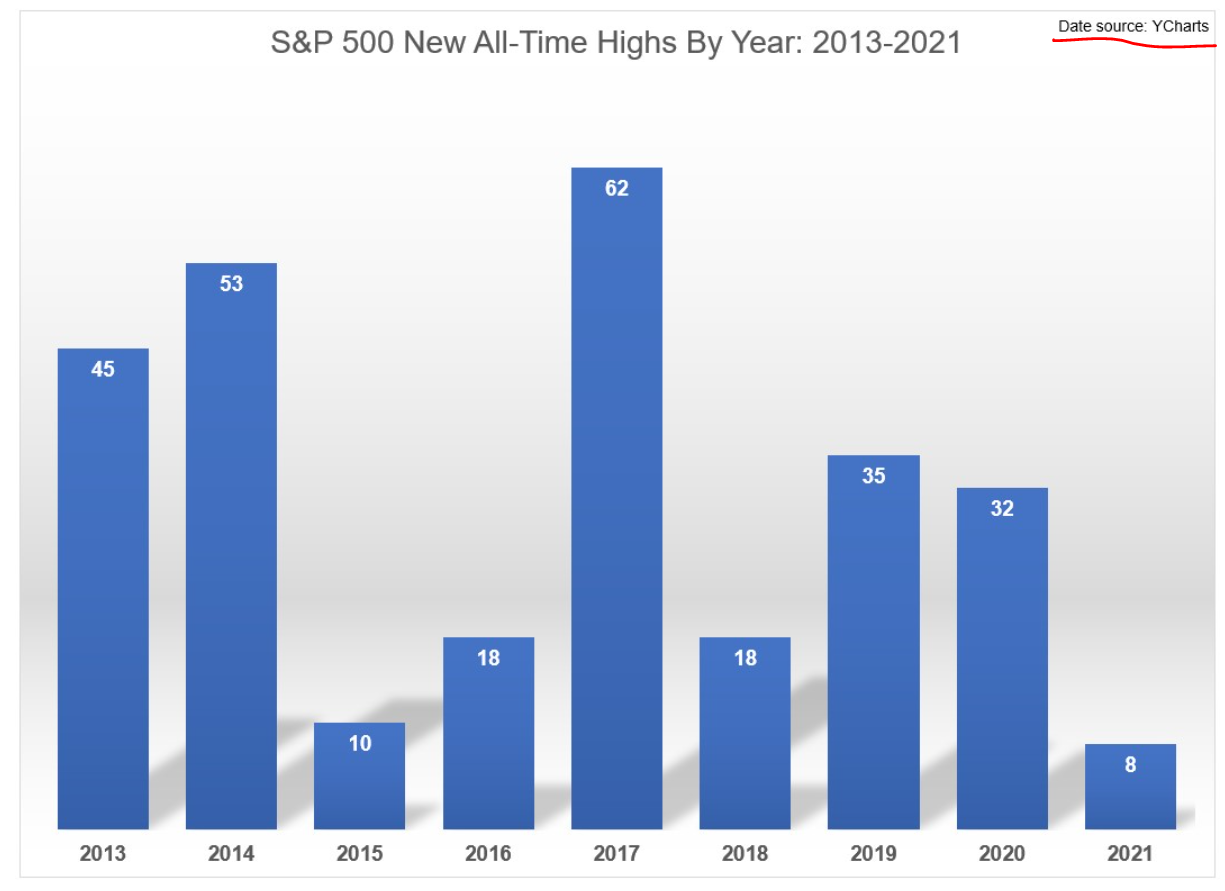

Chart of the Week

As we get near 300 – no typo – 300 new highs in the stock market since 2013, one would hope that the rhetoric about “wanting to avoid highs” would be resisted. But the most bizarre and illogical of arguments (that “new highs” are bad) persists in the lexicon of investors.

Valuations matter. Prices do not. For proof of that latter sentence, I offer 281 arguments in the chart above.

Quote of the Week

“Wealth is nothing more or less than a tool to do things with. It is like the fuel that runs the furnace or the belt that runs the wheel, only a means to an end.”

~ Henry Ford

* * *

I thought our national call this week did a good job of answering questions about a lot of our perspective on things right now. I encourage you to check it out if you haven’t already. I also love discussing capital markets and the defense of free enterprise with friends, if you’re so inclined.

Enjoy the three-day weekend. Enjoy whatever weather you find yourself in. Reach out if we can answer any questions about anything. And we will see you next week with another commentary here in the Dividend Cafe …

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet