Dear Valued Clients and Friends,

Since the new calendar year began just about six weeks ago oil prices are basically flat, having started right around $80/barrel and still sitting now right around the same level. The energy sector indices are all up on the year, somewhere around +1%, so nowhere near the level, the market is up year-to-date, but up nicely nonetheless. It’s not been a rally mode, but it’s not been a sell-off, either.

Yet there is a lot going on under the surface. One can be forgiven for being suspicious of the idea that both the commodity side and public equity side can stay flattish and benignly boring for long.

My goal in this week’s Dividend Cafe is to update our macro perspective on the energy sector and offer some correct practical suggestions around investing in it. It’s a little economic, a little political, a little global, and a lot of fun. But you knew that already … So let’s jump into the Dividend Cafe!

|

Subscribe on |

Strategic Petroleum Non-Reserves

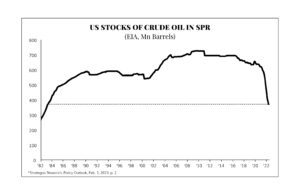

The Biden administration announced in March of last year (late in the month) that they would release one million barrels per day from our nation’s strategic petroleum reserves for 180 straight days. Initially, prices did not respond to the increased supply, and in fact, by July WTI Crude Oil prices were essentially at the same $120 high that we had seen in March in the immediate aftermath of the Russian invasion of Ukraine. A few things need to be said about this:

(1) It is certainly true that the SPR release played a role in bringing prices down and containing the ceiling of how prices would go

(2) It is likely this was politically beneficial for the Biden administration

(3) OPEC’s production in the second half of the year did not help bring prices down as much as the Biden administration wanted but they also played a role

(4) China was essentially locked down for all of 2022 and anyone who believes that impact on global demand was not material to price is wrong (when I started typing this sentence I thought I would be ending it with something more punchy or funny but I just landed it with “they are wrong”)

(5) Like all government interventions, there is a diminishing return over time. The strategic petroleum reserve cannot be the most catalytic driver of oil prices in 2023.

Nixonian economics

A release from the strategic petroleum reserve can serve as a price control for a time, just as a literal price ceiling on Russian oil can. But price controls eventually impact production and diminished production (from organic market levels) creates shortages. Such interventions work until they don’t, and then they don’t work they generally do not just “freeze” – they reverse. Teeter-totters are very hard to stop in the middle.

As first-year economics students learn, price controls do not just control price; they influence production and incentives; and production and incentives ultimately influence the price. Economic laws are like the spirit of Troy – they are hard to hold down for long.

And also …

What goes down must come up. Not only is the ability to continue releasing limited, but the replenishment of these reserves lingers. The administration seems confident that it can replace these reserves without any issue, yet some planned re-purchases have already been canceled, and markets are well aware that such refill objectives linger. Markets are funny that way – they don’t ignore, pretend, or forget.

*Strategas Research, Policy Outlook, Feb. 3, 2023, p. 2

The Strategic Petroleum Reserve only has enough cash to purchase back 84 million barrels of oil, 140 million less than where it was a year ago.

What’s old is not new again

The U.S. dollar and crude oil have long had an inverse relationship (as oil is denominated in dollars on a global basis, for now). When the dollar rallied it to put downward pressure on oil and when it fell it caused oil prices to rally (all else being equal). There has been debate over the years as to what was the chicken and the egg here (were oil prices responding to the dollar or was the dollar responding to oil prices? the answer was, of course, “yes”). But that inverse relationship has historically been dependable when all else was equal.

The issue now is that all else is not equal. The significant and unsustainable period of Fed tightening of 2022 caused the dollar to rally just at the same time oil was rallying behind a huge moment of growing demand (re-opening everywhere but China) and inadequate supply (U.S. silliness and Russian evil). The Chinese Yuan/U.S. dollar has been on a roller-coaster around a lot of trade complexities and divergent economic objectives. There simply have not been dependable correlations between currency and oil for some time that can give us any indication as to whether or not a headwind or tailwind exists here.

Old, New, and Immutable

What doesn’t change when it comes to oil prices is the role of geopolitics in impacting prices. Geopolitical risks are abundant, and many of them embed upward price risk for oil.

At last count, it hardly seems likely that Russia is about to de-escalate things in Ukraine. One could argue that Russia/Ukraine volatility is priced in (I don’t know how one would know that, but it’s not impossible). But is Iranian risk priced in? Are they really about to announce a nuclear capability to the world? And is Israel really about to take that lying down? (Are we???).

What about China’s relationship with Russia? China’s relationship with Iran? China’s relationship with Saudi Arabia? Now, maybe nothing happens on these fronts that impact oil prices at all. But if something were to happen to oil prices as a result of Chinese strategic maneuvering with other non-allies of the United States, do you reckon that impact would cause oil prices to drop or increase? In other words, there is an asymmetrical reality to this issue – Chinese kissey-face with other rogue nations may cause oil prices to rise, but it certainly doesn’t seem likely to cause oil prices to drop (though if you are in the camp that expects President Xi to soon announce his utter rejection of Russian or Iranian bad behavior and his resolute adoption of western values and alliances, I apologize for my presuppositions in the aforementioned conclusion).

In fact, I see greater alliances on the horizon with Russia and Iran, Chinese tacit support of such, and a deepening of the alliances with China and Russia as well as China and Saudi Arabia. I am not going to unpack the unpackable here, but I am going to state the obvious – these geopolitical developments and threats don’t seem likely to create $50/oil any time soon.

U.S. to the rescue?

In Dave-land, yes. In the real world, no. Permitting reform appears to be going nowhere, and all of us are shocked – shocked – that Joe Manchin was double-crossed like that after his support for the “Inflation Reduction Act.” And while there are countless regulatory and cultural reasons that U.S. production is not going to pick up the supply shortfall any time soon, there also are economic reasons at the company and sector level. The energy sector has over-levered itself before in times of high prices, and seen the supply-demand curve move against it, and it will not make the same mistake again. I should make it clear – these things are not all mutually exclusive. An upstream energy sector more enamored of capital discipline than in times past is hardly divorced from a political and cultural environment that is committed to its demise.

The “R” word

Is the flipside to the energy story the possibility of a “recession” (whereby demand destruction impairs volumes and margins, making much of this moot)? The supply curve moving left doesn’t matter much if the demand curve is moving down, right?

I’ve beaten the recession story to death, and stand by the call that I have no call (and everyone else’s call is speculation). What I will say is that (a) A recession-driven downward pressure on the energy sector is no fait accompli, (b) Whatever happens around that uncertainty is up against the aforementioned geopolitical realities, and perhaps most importantly, (c) Is not going to last forever if it does happen. Therefore, the “hedge” to such a demand-impairment to energy investments is the embedded time horizon of the investment.

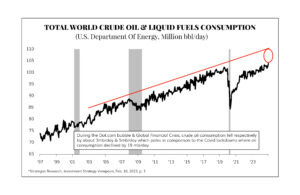

Two can play at this game

And while we wonder if a recession might come along and erode demand, it is important to realize that on the other side of that coin is global consumption of oil which is nowhere near its trendline level. Maybe we face, not erosion of demand, but a catch-up or surge of demand? Maybe?

*Strategas Research, Investment Strategy Viewpoint, Feb. 10, 2023, p. 3

Back to the industry itself

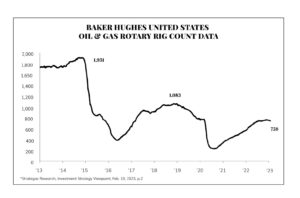

Are our energy executives really rehabilitated, or would they over-lever at peak levels again, bringing the sector back to a 2015 or 2020 level of vulnerability (the 2020 issues may be different since oil producers didn’t cause COVID, but they certainly had their company balance sheets in a position unable to withstand exogenous shocks – regardless of what those could have been)? Consider the following (and note the Chart of the Week below):

- Rigs in operation were as low as 244 in August of 2020 (COVID lows)

- They had been as high as 1,083 in December 2018, when oil was around $60/barrel

- They currently sit at 759.

So, yes, oil rigs are back online to pre-pandemic levels, well off the lows at the place where the whole world was shut down, and yet also well off of the highs of a bygone area of leverage and speculation. And adjusted for price, breakeven levels, and market factors, one could argue that a rig count with oil at $80 equal to the rig count of $60 is not remotely “equal.”

Where does that leave us?

I suspect China adds one million barrels of oil per day to global market needs, or something near that level, by itself (in 2023). The total number is likely to double that, and this is the International Energy Agency’s own estimate.

Russia says it will cut production by 500,000 barrels per day. It did not coordinate this with its cartel brethren in OPEC+. China and India are buying Russian oil cheap but selling it to the world at a profit. Either real-life economic weaponization of oil by Russia is going to happen, or it’s going to linger as a threat of happening.

There are so many unknowns that play into one’s outlook for the energy sector, particularly as it pertains to the upstream part of the marketplace. Our best advice is to view things as follows:

(1) Re-balance upstream exposures if one was overweight the last two years (as we were, and as we now have) so as to reset weightings to target and de-risk exposures in the upstream part of the market

(2) Maintain upstream exposure recognizing that there is (a) An offensive upside potential here based on a variety of supply/demand profit-making possibilities, and (b) A defensive hedge potential based on the potential of geopolitical disruptions and even economic challenges that come from potentially higher energy prices.

(3) View energy as less correlated to the broad S&P for a variety of reasons, and recognize that may be a good thing, or not a good thing, based on how 2023 markets go.

(4) Maintain midstream exposure, overweight, where the rising dividend stream, the volume-driven business model, and the less leverage to underlying commodity prices all point to an adjacent strategy that possesses a very attractive risk-reward trade-off.

Yep. Midstream, again. We’re nothing if not consistent.

Chart of the Week

A tale of several cities – peak insanity with high prices, peak insanity with moderate prices, the destruction from COVID, and now a sensible place where we currently stand.

*Strategas Research, Investment Strategy Viewpoint, Feb. 10, 2023, p. 2

Quote of the Week

“The selfish fear change. The selfless lead it.”

~ Simon Sinek

* * *

Enjoy the three-day holiday weekend ahead. There will not be a DC Today on Monday as there will not be an open market, but we will be back with you Tuesday. Reach out as always with questions, and go Pacifica!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet