Dear Valued Clients and Friends,

This last week appears to (as of Friday morning’s press time) not been a particularly active one in equity markets. The Fed had no big announcements. Bond yields barely budged. Earnings season is very close to complete, and companies doing reporting of results have become few and far between. We are in a market news cycle lull, which is the perfect time to talk about alternative investments. “Huh?,” you ask. “What does the news cycle have to do with alternative investments like private credit?”

All will be revealed. But in the meantime, I guess I should clarify that I never believe Dividend Cafe should be tied to a particular headline or market event. I may choose to do so here and there. But even then, those “ad hoc” news events become relevant to the Dividend Cafe only to the extent the lesson or message itself is a permanently relevant message. Some may be delivered in a more “timely” context than others, but what I want every week’s Dividend Cafe to be is something that can be read any time past, present, or future, and stand up. Day-to-day market reporting and analysis has its place (barely), but the Dividend Cafe is my baby for macro, evergreen truth and perspective. It will be the last thing I ever give up in this full-time endeavor, and by give up, I mean something rather morbid.

So I write in today’s Dividend Cafe about something unrelated to the news cycle, the headlines, and big market noise, not merely because it was a quiet week on the western front but because every week should be a topic divorced from noise and focused on substance. Noise is the enemy of investor success. I just figured today’s message might find a little more focus from the readers when there really is this opportunity for quiet around the other obsessions of the moment.

So, without further adieu, let’s discuss the state of private credit before Travis proposes to Taylor, or Jay Powell gets a new briefcase, or Bill’s Burger Joint launches an AI-focused menu option. Let’s jump in, to the Dividend Cafe …

|

Subscribe on |

The New Normal

One of my favorite Dividend Cafes of 2023 dealt with the exciting trend for lending needs in our economy to be increasingly provided by risk-taking investors (via pooled vehicles run by asset managers) versus the reliance on deposit-taking institutions known as banks. I believed then (and still believe now) that we are living through a post-financial crisis evolution where more and more of our lending needs (which is to say, borrowing needs) can be met outside the traditional commercial banking system. Direct lending, private credit funds, structured credit asset managers, and a whole host of other non-bank lenders have seen their assets explode as more and more borrowers from small businesses, to commercial real estate actors, to even large publicly held businesses, to many shapes and sizes in between, pursue different forms of debt for different reasons and in different terms and conditions.

I argued last May that this is a positive thing for a multitude of reasons. For one, the systemic risk is diminished when commercial banks are doing less lending that may lead to loss. Losses in the banking system have the potential to become contagious. If this fact is disputed, I have a history book for you. There is a greater capacity for isolation of risk when more of the lending is done by non-depository institutions – in other words, when the losses would be absorbed by risk-taking investors versus non-involved depositors.

But additionally, beyond the systemic risk considerations, I believe that private credit provides benefits to borrowers (more market-created dynamism in the lending transaction, more customization outside regulatory capital requirements, more access to strategic resources and services, and far greater optionality for workouts in the case of loan impairment).

And then, finally, and perhaps most selfishly, as an investor and a financial intermediary, I believe this trend is exciting for those looking to deploy capital. It has created a host of opportunities that previously didn’t exist, whereby attractive returns are available in a context of illiquidity premium, underwriting prowess, and deal flow, all tied to a given risk profile, yet with spreads above various public market opportunities.

Private credit has shown itself to have low correlation to stock and bond markets, often negative correlation, and it has grown to a place of being a scaled, broad, mature, diverse opportunity set for investors. I see the systemic benefits, the borrower benefits, and the lender benefits as all significant.

But let’s be real

A general concern has been, not that I am wrong about all I just said, but that I am right. How long can something stay good without becoming a victim of its own success? When was the last time good money didn’t attract bad money after enough time? Can we really have a sustained period of low defaults, high spreads, dependable return of principal on top of high single-digit and low double-digit coupons, and not, eventually, see a lot of money flow into terrible deals? Doesn’t Amazon eventually create Pets.com? Doesn’t FOMO mean some charlatan (or if not a charlatan, some moron) will still get money from some unsuspecting rube?

Lo and Behold

Indeed, the calls have been escalating for quite a while. “The low volatility is a disguise. There is no free lunch. You can’t get returns this good without risk. The bad loans are coming. The impostors are coming. The ‘mark to market’ pricing is fake.” Rinse and repeat. These accusations are concerns, and some derivatives of them are easy to find. The question becomes separating the wheat from the chaff. What are the legitimate concerns about an asset class that went from practically non-existent to massive? Who is a disgruntled competitor merely talking their book? And what is the truth about the risk and reward profile of a reasonably inefficient asset class now experiencing media attention and broader investor interest?

Mark to fantasy again

So here is the buzz I want to reply to … First, the claim is that the “marks” (what the loans or funds filled with multiple loans) are shown to be worth is overly ambitious. The “marks” and their methodology are either opaque (not clear as to where they came from), or they are false (the asset manager knows they are worth less but is saying they are worth more), or pollyannish (the asset manager may believe them but the asset manager is wrong). I have written about the embedded challenge in marking all private assets before – whether it be a loan, a lemonade stand business, or a piece of real estate. The critique of private credit for marks invites some feedback (hang in there) and also addresses an issue that is known to be unsolvable – that is, how to mark something that has not sold at a real price and isn’t about to be sold at a real price.

In other words, half of this critique is super-stupid. Mind-numbingly dumb. The carried value on an illiquid asset has been made up out of thin air forever when it comes to real estate. Those who are lying to themselves (with real estate it is generally a requirement for membership to be willing to lie to yourself and others about the value of your holdings) are not hurting others – and arguably not even themselves (until a point of sale) – and those who are intermediaries putting a “mark” on the net asset value of a pool of illiquid assets are hardly “lying” to people as long as the people know the reality of illiquidity embedded in my above link.

But there is half of this concern that warrants some attention. Are the loans actually distressed, actually set to recover more than par value, and yet being cosmetically doctored to paper over the embedded reality of value deterioration?

Valuation 101

Interest rate risk is removed from floating-rate debt instruments. If you have a bond worth $100 at purchase and at maturity and it pays 4%, and then the prevailing interest rate goes to 5%, your bond is worth less money. If your bond pays 5% and the prevailing interest rate goes to 4%, your bond is worth more money. This is basic math and basic finance around fixed-rate par value debt instruments. But private credit is almost always attached to a floating rate, meaning, as rates go up in the marketplace the rate being paid on the loan goes up, too. Therefore, interest rates do not move the value of the bond up or down.

So a floating rate credit instrument bought at $100 and paying back $100 is always worth $100 as it pertains to the income component of the loan. But there is more! How do you account for the possible loss of value from default? This involves a probability calculation (how likely is default?), a magnitude calculation (how much impairment would there be), and a recovery calculation (how much would assets and collateral and protections recover in value). It stands to reason that the longer term the loan is, the harder it is to assess probability; the more junior in subordination, the harder it is to assess magnitude; and the fewer covenants and stipulations, the harder it is to assess recovery.

So what do we know about private credit? First, the loans are generally short-term in maturity, with a weighted average maturity of around three years (yes, a five-year loan in private credit is “long term”). In other words, probability is much easier to assess because we are talking about short-term, not long-term, loans. Second, the loans are almost always “senior-secured” or “first lien.” That is, they are first in line to get paid, have loan-to-value ratios that indicate magnitude of loss, and are quite measurable. And finally, the loans are filled with covenants and conditions that speak to the underlying facets of the business, cash flow ratios, management, etc. The sponsors are often well-equipped to take over and drive a recovery process, usually with vast experience on the equity side of a business, too. In other words, while defaults are defaults and bad things happen in business, probability, magnitude, and recovery are vastly more measurable than critics seem to understand.

Proof in the Pudding

Of course, all of that may sound very good in a white paper or in a Dividend Cafe, but what have real senior-secured, first-lien, floating-rate private loans done in real life through multiple credit cycles in terms of default and recovery? The historical evidence is clear that marks near par value have proven entirely justifiable. If some wave of defaults happen in the future where recoveries prove worse than the historical average, perhaps the pricing across the asset class will be re-rated, but right now lower marks would be based on a prediction, not a valuation. I thought we were trying to avoid that?

Investor reality

Across a pool of loans, an investor does not have the default risk and recovery risk of one loan – they have a diversified set of loans. Valuation discrepancies may take place on a loan here and a loan there, but when the quantity of loans is increased, the discrepancy becomes less and less statistically visible. Asset managers with hundreds or thousands of loans have almost no statistical variation from one another at all. This simply isn’t a real-life issue – the “marks” of certain loans from one asset manager to another.

What does matter is that the investors in private credit cannot sell their funds of loans (or individual loans) on a whim. Comparisons to the market value of public loans (or, more importantly, the volatility of public loans, say, in the bond market or CLO market) are absurd. Liquidity has a cost, obviously. Selling a loan in the public market means giving up a point or two for the ability to sell it. This is also finance 101. The sentiment, emotions, desperation, and all-purpose rational (or irrational) circumstances of investors who can sell change price fundamentals for those who cannot.

Some might say this is a feature, not a bug, of private credit.

The legitimate concern

I am entirely sympathetic to the argument that the popularity and success of this asset class is going to draw in a lower quality investor investing with lower quality asset managers who are originating lower quality loans with lower quality borrowers at lower quality businesses. I don’t suspect this could happen; I completely assume it will.

The issue is what to do about it. Is the inevitability of some bad private credit strategies an argument against good private credit strategies?

I say, of course not.

Spreads are very high right now. The high floating rate of these loans has resulted in wonderful returns. I fully expect the return profile to come down 100-300 basis points. I fully expect some defaults somewhere. Double-digit returns do not exist without risk. I like the 7-9% targets more than the 11-14% targets.

But underwriting matters. Loan quality matters. Loan-to-value ratios matter. Alignment with sponsors matters (meaning, what the equity sponsors of different borrowers would do in the case of distress). Terms and conditions matter. Attempts to paint the entire private credit space with one brush are absurd.

Conclusion

A lot of bad restaurants have been started over the years in pursuit of the great profits and opportunities seen out of good restaurants. Never, at any time, has this caused me to stop eating. Eat at the good ones, invest with the right managers, expect some bad meals here and there, even at good restaurants, and thank God we live in an economy and a period of capital markets that allows new restaurants to come online Unpack all the mixed metaphors and equivocations in this paragraph for your own edification.

Chart of the Week

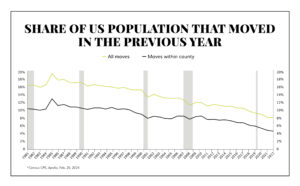

Unrelated to the subject of this week’s Dividend Cafe, I remain obsessed with labor dynamism. Maximizing productivity means maximizing mobility, and a part of that dynamic workforce I believe in is the ability and propensity to move for opportunity. It is declining rapidly, and I think this reflects both the “real estate freeze” we are living through in this “low rate” to “high rate” interest moment, but more perpetually, it reflects a declining mobility that weighs on labor dynamism and, therefore, economic productivity.

Quote of the Week

“The problem with socialism is socialism. The problem with capitalism is capitalists.”

~ William F. Buckley

* * *

I am off to New York City at 6 am Saturday morning and looking forward to being back there in the NYC office for a few weeks. There has been a lot of movement these last few weeks and having a time of being handcuffed to my desk sounds lovely.

Reach out with questions and comments, and get ready for one of the greatest months of the year. March is a special time, my friends. To say otherwise is madness.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet