Dear Valued Clients and Friends,

It’s been a weird week to pick a topic for the Dividend Cafe. I have about six topics mapped out for future Dividend Cafes, yet none of them grabbed me to do this week. I took an Acela to DC from New York on Wednesday late afternoon and felt pretty inspired about one topic, and then felt inspired about another as I took the train back to NYC 24 hours later. I did a panel with David Malpass, recent president of the World Bank and Treasury Department Deputy Secretary for three Presidents, at the Library of Congress yesterday, and when I came off that stage, I had a whole new inspiration for today’s Dividend Cafe. I did a podcast with John Mauldin earlier in the week that put many ideas on the table (as all my talks with John always do). We had a State of the Union address last night and experienced “Super Tuesday” just a few days ago. The White House announced plans for credit card fee restrictions this week. And the Fed announced a reversal of plans for onerous new “Basel 3” capital requirements on banks.

Do you see what I am saying? I have had one idea, inspiration, or fodder after another for this Dividend Cafe all week, and when it comes time to put pen to paper, the only choice I have is to do …. All of the Above!

Jump on into the Dividend Cafe. We have a lot to talk about!

|

Subscribe on |

A Debt Limit that Can Work

I have been critical of the debt ceiling in the past because it doesn’t deal with the real problem – excessive spending. Proponents of a debt ceiling say it is needed to control excessive spending, but of course, it has done no such thing. Proponents reply to that by saying, “Well, yeah, it is because someone always gives in and moves the limit higher,” to which I say, “Yes, someone always will, and they wouldn’t need to do that if the spending were just right-sized, to begin with – so if you have the resolve to let the limit stand then just have the resolve not to pass the spending that pushes the debt level higher.” At the end of the day, the debt limit as it stands does nothing to rein in spending but creates added costs, tensions, and volatility in financial markets. It’s as imbecilic as anything I have ever seen in public policy.

But David Malpass has a plan. A senior Treasury official in three Presidential administrations and the recent president of the World Bank, Malpass suggested at the Coolidge Foundation symposium in Washington DC that if spending is passed when the debt-to-GDP ratio is above a certain threshold (he is suggesting 100%, so if PUBLIC debt – the debt the federal government owes to anyone but itself – is above 100% of GDP) – then no one in the Congress gets paid, no staff can be hired, no bonuses paid, etc. Basic minimal salaries and health premiums can be covered. Still, a significant incentive can be embedded into actually enforceable case law that codifies what happens to lawmakers when lawmakers exceed these limits.

David’s theory is, “Ummmmm, debt-to-GDP will stay under the threshold.” I will go on a limb and say I agree. The theory is that annual budget issues are too easy to game, but total aggregate debt borrowings divided by measurable GDP are not. This is just a little food for thought for Dividend Cafe readers.

If the party is this fun, why aren’t more here?

A fair question about private credit and the merits of the asset class I offered last week: Why wouldn’t banks join the party?

In fact, Wall Street investment banks like JP Morgan, Goldman Sachs, and Morgan Stanley have announced huge plans for originating in the private credit space. Their efforts with private credit do not come from bank reserves; they must be from either balance sheet capital (heavily limited by the Dodd-Frank Volcker Rule) or from money raised by investors (and that is precisely what these firms are doing – simply competing with other asset managers by raising a private credit fund of their own, independent of bank capital).

Part of understanding this is in the vocabulary. By definition, private credit is non-bank lending. If it is lending from a bank, it is not private credit. But if it is a loan from a bank, it is subject to the bank’s underwriting standards and, more importantly, regulatory requirements. Private credit is essentially lending where banks can’t, lending where banks won’t, or it is competing against banks and winning (despite higher borrowing costs). Quickness to market, opacity (so competitors do not see things borrowers do not want to be seen), strategic services from lenders and sponsors – there are plenty of reasons borrowers may use non-bank lending as opposed to bank lending. However, commercial banks have regulatory capital requirements and are almost always asset-backed lenders (i.e., residential mortgages, commercial real estate) or personal guarantee lenders. Non-bank lending is usually secured by cash flows, not assets.

Taking the Basil out of Basel

When Michael Barr was named Vice Chair of the Federal Reserve for Supervision, his major platform was to introduce Basel III requirements regarding bank capital. The Basel III standards would have required, on average, 16% more capital to be held by the nation’s largest banks, a massive increase from current levels and something vehemently opposed by the banks and financial markets.

Chairman Powell never seemed on board with the proposal, and this week, he announced that he and Barr are reworking the proposed changes. How banks calculate losses, the risk weighting of certain assets and a change in how deposits are measured by customer type are all expected. The bottom line appears to be capital requirements that do not become onerous and damaging to a bank’s profitability pursuits while better aligning policy with liquidity and balance sheet realities.

This is probably the most substantive news of the week and appears to represent a huge dodged bullet.

The Law of Unintended Consequences

We heard this week of plans the Biden administration has to cap the “late fee” that credit card companies can charge for late payments at $8. This stipulation from the Consumer Financial Protection Bureau may or may not happen, and people may or may not believe that credit card companies should be charging late fees when borrowers pay late. What I do know is this – there are only two things that can happen here: (1) Other companies lower fees and attract credit card business that way, causing competition to put downward pressure on prices; or (2) The moneys not being received from these fees due to government limits gets replaced with higher interest expense or some other form of cost-to-customer that is not currently being imagined.

I have no doubt that this policy initiative’s intent is to help people. However, I also have no doubt that it will hurt those people it is intended to help the most.

Does Greed Cause Inflation?

No, but it cures it.

The idea that companies raise prices out of “greed” is not a new theory, and some of the things uttered at the State of the Union last night are not necessarily the most economically ignorant ever uttered (that prize would take a lot of adjudication to figure out). But this idea that “greed” is causing inflation deserves some economic scrutiny.

Is “greed” a transitory thing? Does greed come and go? Does it stay contained? Why did inflation average 2.17% from 1990-2020 if inflation is caused by greed? Did companies take a thirty-year break from greed and then get greedy just in 2021?

Inflation is caused by too much money chasing too few goods, and I have discussed it ad nauseam here in the Dividend Cafe. But one thing that caps price increases is competition. The profit calculation that often finds volume to be more important than price and general pursuit of market share, pushes prices down. Modern history is filled with companies cutting prices to add to their overall profits.

Call that greed. Call it self-interest. Call it economic calculation. Call it human nature.

But don’t call it inflation.

Solving for a valuation problem

I am of the opinion that many stocks face a problem of valuation. I don’t see signs of a credit crisis. I don’t see signs of systemic bubbles. But I do see high and frothy valuations in parts of the market, and those parts of the market are the heaviest weightings in the composition of the stock market. Sometimes, valuations become a big, fat bubble, and when they are tied to debt (i.e., levered), the bubble can burst and create a negative feedback loop (selling that begets selling). Candidly, it is a fairly miserable thing to live through (or to manage through, professionally).

I have shared my opinion several times that we are in a consolidation period for the stock indices, likely to result in a sustained “range-bound” market. It should be pointed out that the solution to a valuation excess is basically one of three things:

(1) An asset bubble bursts when that excess price is tied to excess leverage. Think: Japan, dotcom, 2003-2007 housing, 2022 crypto

(2) A bear market – a drop in prices of 20% to get something 20% over-valued to “fairly valued.” Think: Math.

(3) A long, range-bound market where prices stay about level even as earnings grow, allowing the excess valuation to “right-size” over time.

So I ask you, which of those three would you prefer? I propose that I am not being the pessimistic one when I talk about a multi-year range-bound market.

The Election Ejection

For those who missed DC Today yesterday, I want to paste the “What’s on David’s Mind” section.

All of the hype going into tonight’s State of the Union speech, and the fact that the Presidential primary season is over (if it ever even started), basically means that I now have to start talking about politics, the election, and the markets. I would rather not, but I guess I have a job to do. I am dreading the next eight months with a holy passion, but that is probably more related to the cultural reality of the moment than anything related to markets. The general reality is that it will be a close election, that markets can’t price in various outcomes around the White House alone (but rather need to know the Congressional outcomes of both chambers to see what is likely legislatively and otherwise), and that most people assume markets and the economy respond to what they want to be the case politically, and not something else entirely. That latter point is a general (and bipartisan) observation of human nature, and not meant to be a critique. It just is what it is. People are emotional, opinionated, animated, and sometimes a tad irrational. And that’s regular people! You should hear what I say about politicians …

No, the markets are not waiting with bated breath to see who will get elected. The forces that drive interest rates, the profit motive, production decisions, business sentiment, and so forth and so on, are all exponentially stronger than any election cycle. But policy matters. Personnel matter. And I will be on the case between now and the end of the year when it comes to covering the nexus of money and politics, even if it kills me.

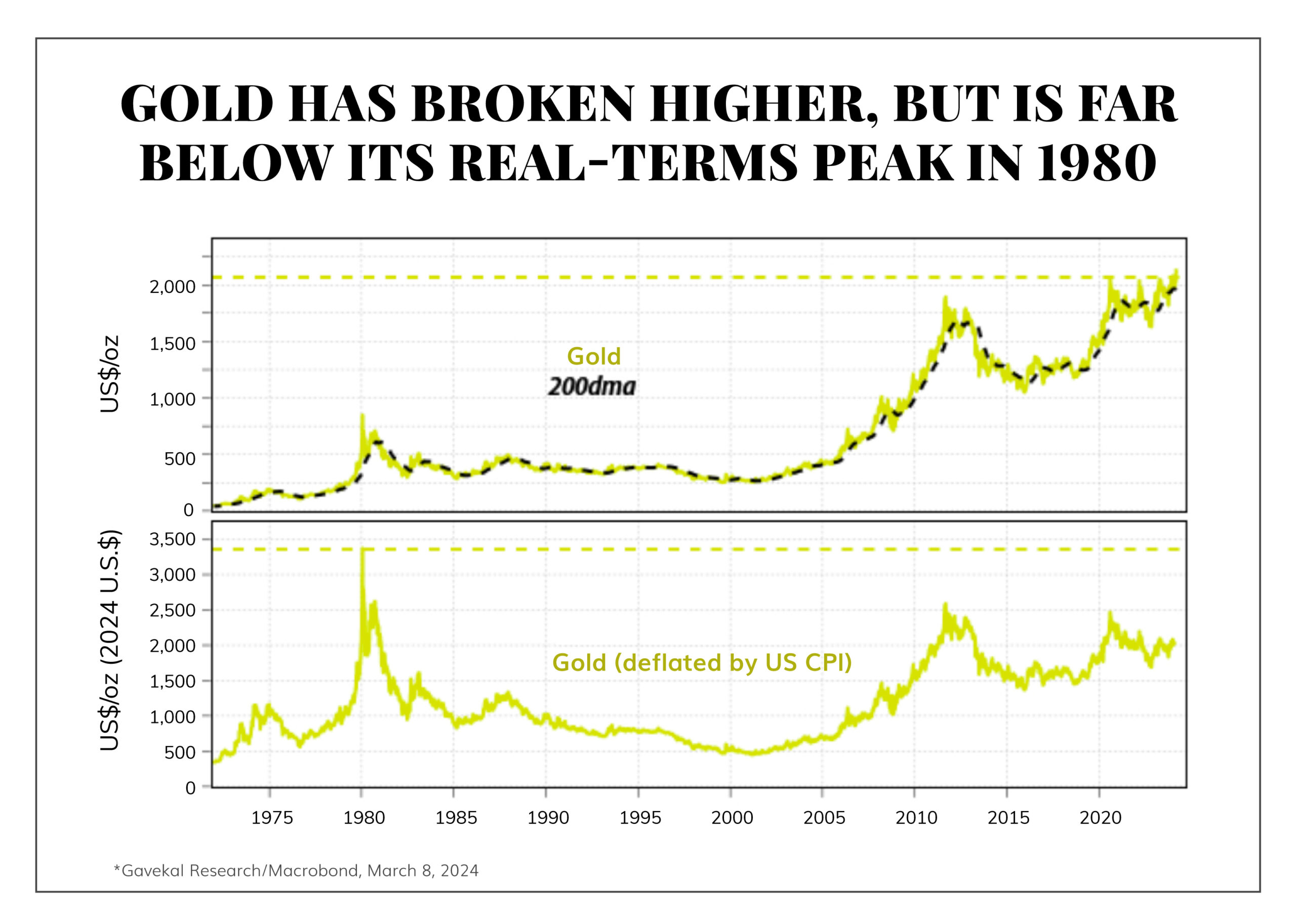

Chart of the Week

A periodic reminder that when it comes to inflation and the preservation of purchasing power, gold is down -35% over the last 40+ years … Put differently, if gold were +35% higher right now, it would be EVEN to where its inflation-adjusted price was in 1980. That is not how most people define an “all-time high.”

Quote of the Week

“The most important thing in communication is hearing what isn’t said.”

~ Peter Drucker

* * *

Well, that’s one way to resolve indecision about a Dividend Cafe topic. I enjoyed going around the horn a bit, and I have a pretty good idea of what I will do next week. I am also excited to spend next week in the New York office with no travel, no planes, trains, or automobiles—just my desk, a lot of meetings, and the greatest city in the world.

Enjoy your weekends! March is a lovely time of year.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

dbahnsen@thebahnsengroup.com

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet