Dear Valued Clients and Friends,

I think this is a good week to do something many people will not be expecting. I don’t do clickbait, and I loathe the sensationalism of most financial writers. But because most financial writers make their living writing about finances and I make my living managing real finances, I have never been captive to the sensational. I can just call balls and strikes, be my authentic self, and share a point of view that I believe is rooted in truth and cogent thought. I can be wrong, but I am not ever melodramatic.

So when I say this week’s Dividend Cafe may be unexpected, it is more about the sentiment and buzz in the air these days, not about me or any “shock and awe” I am going to deliver. And in fact, the surprise may take the opposite shape of what you expect.

So jump on into the Dividend Cafe, and let’s look at the shockingly unexpected news that, wait for it – the American economy has not been the dystopian nightmare many have assumed it to be.

|

Subscribe on |

Incentives

It is a basic fact of economics that incentives drive behavior. Incentives to do something, net of trade-offs, generally leads to more of it, and incentives not to do something, net of trade-offs, generally lead to less of it. And there are few economic principles more at play in how one talks about the economy than incentives.

I used to believe that there was a cottage industry of doom-and-gloomers who were mostly a by-product of a certain sociology … Their own disposition was oriented towards an apocalyptic view of things, and that bled through into their view of the economy. What I learned over the years is that it was more nuanced than that. Many professional perma-bears do, indeed, have a genuine sociological leaning towards the “world is ending” view of things, but at some point in their journey, that viewpoint became a profession. They figured out how to monetize prophesies of the economic apocalypse, and from that point, there would be no variance. From newsletters to speaking fees to books, the revenue stream all depended on one thing – finding new ways to continually think and continually write about how bad it all is.

Notice what I said there – first, to think, and then, to write. I do believe that the economic incentives in the cottage industry of perma-bearism require them to do their best to actually believe it. You could argue that there is a cognitive dissonance at play (I assure you, most professional perma-bears do not live as if they think the economy is about to spiral out of control tomorrow), but I think for all sorts of psychological and behavioral reasons, the real evangelists for this religion of grift and fearmongering do their best to actually believe what they are saying. Their business model depends upon it.

The idea that incentives are behind many people’s outwardly stated economic outlook is not only affirmed or validated through the perma-bear world. There seems to be a more organized attempt at creating an actual platform of absurdity in their pathological pessimism (the websites here are legion), but they do not have a monopoly on allowing self-interest to shape economic outlook (and by outlook here, I mean past, present, and future). If you are a politician running against an incumbent as a challenger, you have a strong incentive to lean into what is wrong with the economy. If you are an incumbent politician fending off a challenger, you have a strong incentive to lean into what is strong in the economy. People selling dreams want to prop up the good. People selling panic and want to prop up the bad. And people selling nothing want to scare the &^%$ out of you.

What a world!

The Death of Nuance

I have written many times about the challenges of being nuanced when it comes to describing the market in the context of media. I can say whatever I want, in however many words I want, with all the caveats and nuances I want, in my own forum (like this Dividend Cafe, lucky you). But soundbites on television necessarily limit the opportunity for nuance. This goes beyond the current moment; as I have argued, there really are arguments for and against a recession in the next 6-12 months. Most (not all) short-term horizons allow for “on one hand” and then “on the other hand” arguments about the economy (this is the reason Harry Truman famously said he wanted a one-armed economist).

It is not just short-term forecasts for the economy that require nuance (and humility). Even longer-term explanations (backward-looking) and longer-term forecasts (forward-looking) require more verbiage than “good” or “bad” – as if some caveman is trying to say what he thinks about a meal. Nuance is the enemy of the tribal, and we are, above all else, tribalized at this moment in time.

Let’s do a thought experiment. Imagine you turn on a TV news network and see a person in a suit in 2023 saying, “the economy is doing well overall, measured by good wage growth and really low unemployment.” Would you just assume it was a Democrat hack pumping sunshine for President Biden? What if you turned on the TV in 2019 and saw someone saying, “GDP growth last year was the best since the financial crisis, and unemployment and inflation are both low” – would you just assume it was a MAGA Trump hack?

Because guess what. I am not a Democrat hack for Biden, and neither was I a MAGA Trump sycophant. And yet that person was me in both cases.

Of course, in 2019, I also would have added the uncertainties posed by the trade war, and in 2023 I would be adding the tightening financial conditions putting the economy at risk of a future recession. In other words, both sides looking for economic commentary to match their political priors would have been upset with me in both cases. But no matter who said any of the things in the last few paragraphs, all of them would be fully and indisputably true.

Objective discussions not only require depoliticization, but they almost always require a sort of nuance that is not binary. Economic conditions are usually not monolithic and universal. Sure, in 2008, one could pretty much say without caveat, “so this is not great!” But it is rare, in good times or bad times, that some form of nuance is not the right thing for the objective commentator.

First, the past

Let’s get out of a discussion of the current economy, with its 3.6% unemployment rate but contracting manufacturing; with its robust consumer activity but declining financial conditions; with its high unfilled job levels but declining skills and productivity; with its freeze-up of capital for commercial real estate, but reasonable spreads in corporate credit. The current economy is a walking amoeba of nuance. But let’s take a longer-term view of things.

Have we come from a place of greatness to a weaker place of economic distress? Or have we seen steady economic progress throughout history, with intermittent periods of distress and difficulty along the way? What is the real story of the past and now the present, not looking at three months, but as much as three centuries?

Against Doomsdayism

I write an “against doomsdayism” section every Monday in The DC Today because I believe we generally suffer from a lack of gratitude for the progress of civilization. I believe one can, and should, be concerned about oil prices while still recognizing that global poverty has collapsed by 80%. I believe one can, and should, recognize that we have an excessive national debt while still recognizing that our plumbing, sanitation, and water filtration systems available to the masses would be unfathomably luxurious for the wealthiest people in the world just decades ago.

These things are facts. They don’t lend themselves to doomsdayism.

The Economy from a Truthteller

Here is what must be said about the free market economy system that America largely holds dear:

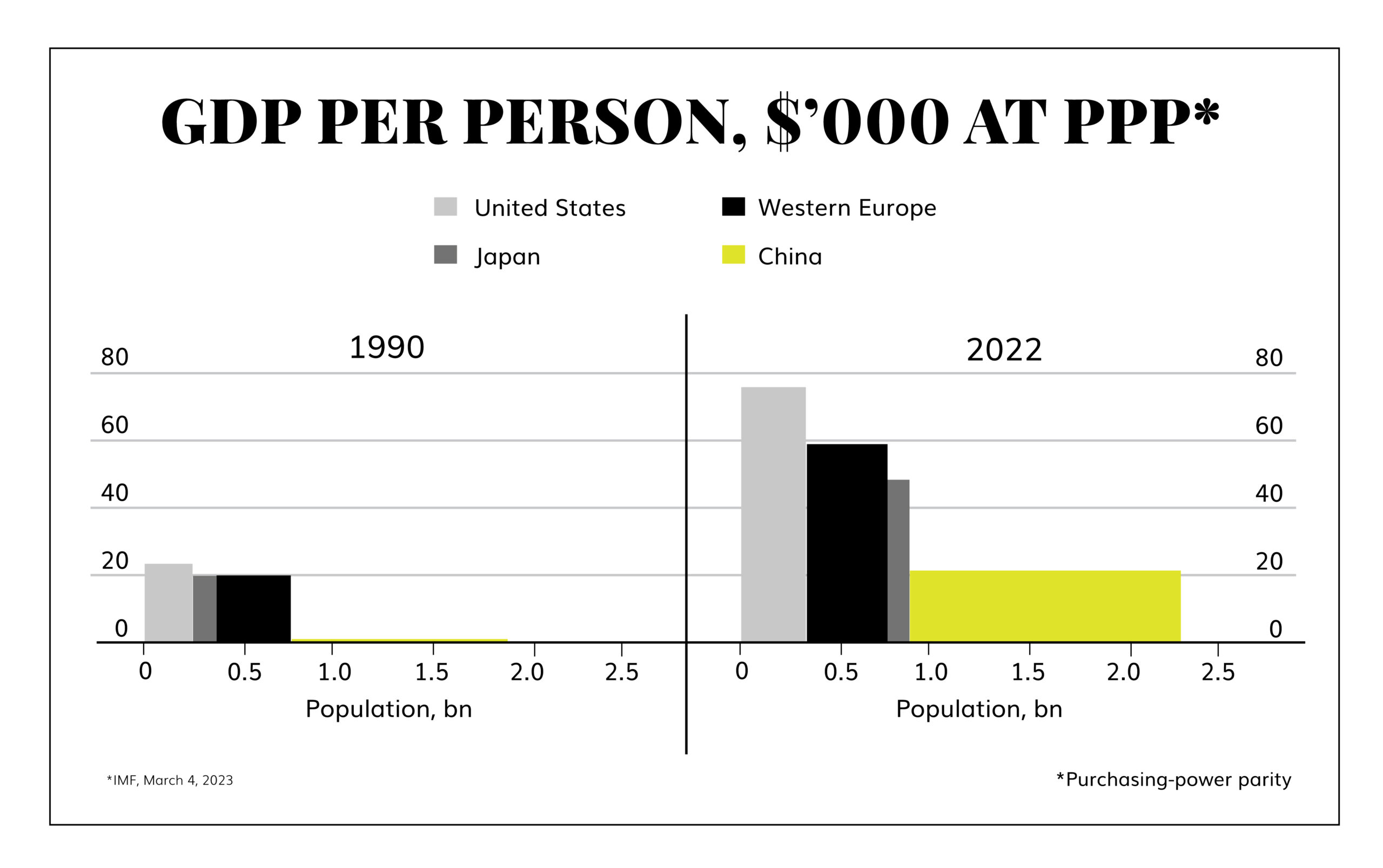

- Our GDP per person was basically the same as Europe’s and Japan’s thirty years ago. Then, for 33 years, we have had booms and busts, good times and bad times, smart decisions and insane ones, and somehow our GDP per person is 33% better than Europe’s and nearly 60% better than Japan’s.

- Our economy has gone from 40% of the GDP of the G7 to 58% – a massive increase in the relative size and power of the economy compared to the rest of the developed world in just thirty years.

- Our income per person is 30% higher than the income per person in Western Europe

- Our labor productivity is up 67% in the last three decades (more than any other developed nation)

- While China has EXPLODED in size and contribution to the global economy over the last three decades, the U.S. was 25% of the global GDP thirty years ago and is still 25% of the global; GDP today.

- Adjusted for inflation, our millennials make 9k more per year than Gen X did when Gen X was the same age and 10k more than baby boomers did when they were the same age (again, adjusting for inflation!).

- American poverty is at an all-time low

h/t David Brooks, The Economist, and Kevin Williamson

But?

Sorry, but I know housing prices are unaffordable for too many and national debt has exploded, and total productivity is not where we need it to be (we aren’t working enough to capitalize on the increase in labor unit productivity because we are content to do the same with less instead of doing more with more). I know all the negatives. There are a lot of them.

And the worst thing (to me) is not just that there are counter-points that speak to negative economic data; even the positive economic data speaks to an economy performing very well but perpetually below its own potential. Even when things are great, I have no problem wishing they were even better were it not for bad policy, intervention, or culture.

But again, nuance requires one to admit – things. have. been. pretty. good.

So yes, “but” – there are significant headwinds, not the least of which will be the excessive government indebtedness we have taken on, which was not as excessive 30+ years ago. I believe low/slow/no growth Japanification is a real thing.

But I also know those deflationary and stagnationary forces are fighting an economic engine that has been to the world what Michael Jordan was to basketball, the greatest of all time – an unstoppable force of nature.

Conclusion

There are numerous destabilizing forces at play in the U.S. economy, with many of them created by a monetary policy I find unwise and resulting in slowing growth, I find unacceptable. Yet the U.S. economy is, at its root, the human activity of a pretty robust population with pretty high skills and a pretty strong drive and aspiration for a better life. Yes, I want it to be better, and I fear the cultural ramifications of a non-meritocratic push and a Japanified result in our fiscal and monetary endeavors.

But no, the U.S. economy is not out, is not kaput, and has not been leaving people by the wayside. It is the envy of the world, no matter who is President or who is on TV talking nuances and objective truths.

Chart of the Week

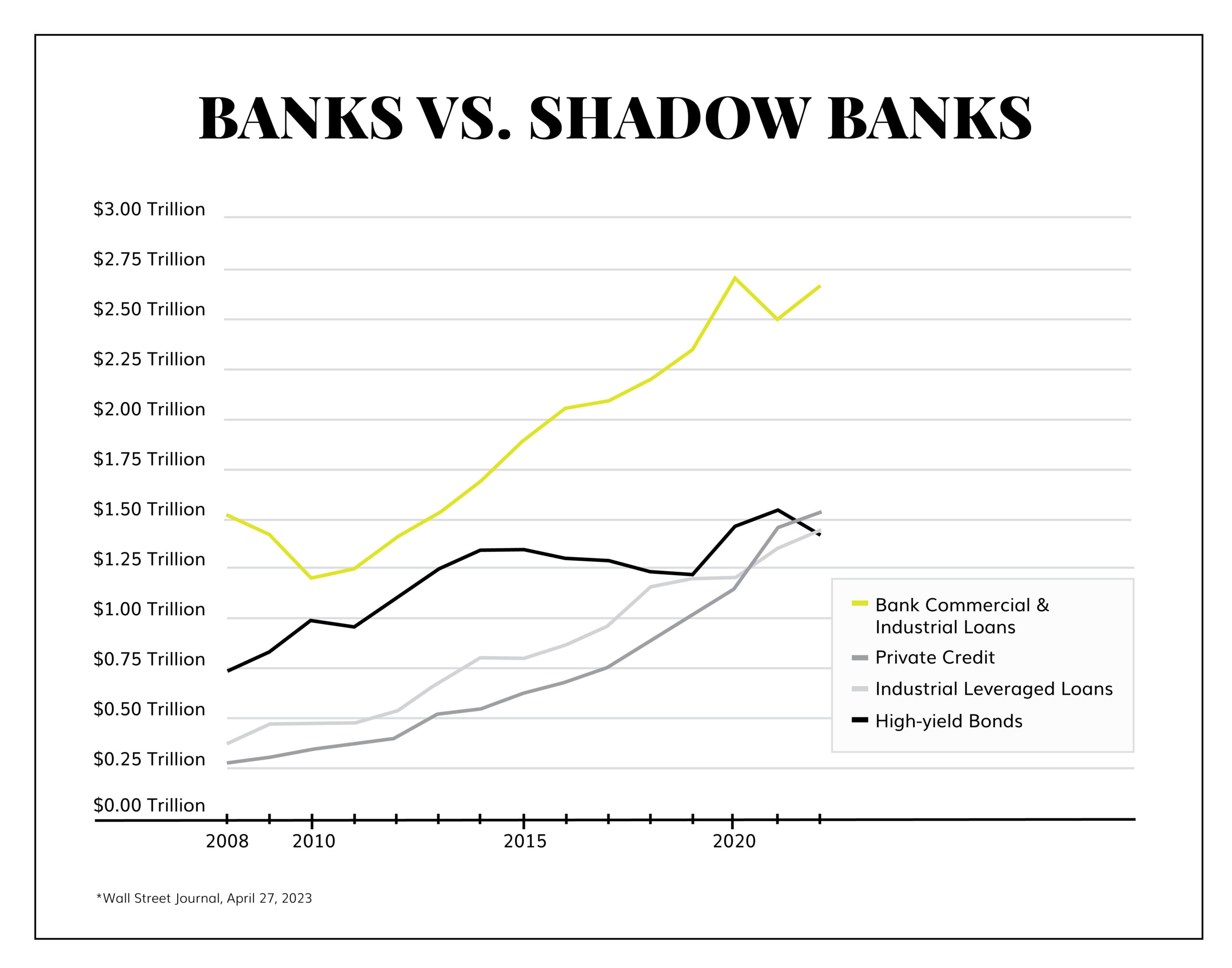

Some may wish (foolishly) to see a half-empty glass here. What did our financial markets do when the post-crisis regulatory regime left our traditional banks unable to lend (growth only 83% over 15 years)? It saw private credit increase 600% and levered loans about the same. In other words, our robust capital markets financed what our pre-2008 banking system could not. This is my half-full glass.

Quote of the Week

“We have problems. Prosperity gives us choices about how we deal with them, resources to deploy, and a cushion to help us over the rough patches. Good intentions are fine, but good intentions and a $27 trillion economy will get you a lot farther than good intentions alone.”

~ Kevin Williamson

* * *

Our Texas office opened this week, I spent a few days in our Minnesota office, and I am working on my book (on work) all weekend. It’s been a doozy of a week in markets and in our offices, and I wouldn’t have it any other way. I am so grateful for so many things, including this economy. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet