Dear Valued Clients and Friends,

I have been waiting for about eight weeks to do this – not write a Dividend Cafe about Warren Buffett, but to not write about tariffs. The fact of the matter is that these Dividend Cafes have been important, and I am not complaining about the tariff issue’s dominance. The infamous April 2 “Liberation Day” announcements necessitated obvious treatment, and I feel the Dividend Cafe did well in the tumult of that period. I am not sure I thought I would ever write a Dividend Cafe about the psychological motivations of an elected President when I began writing a weekly market commentary in September of 2008, but I suppose I would rather write about that than what I was writing about in September of 2008 (oh how quickly we forget what real drama feels like). The tariff issue (with the tax bill issue behind it) has been the dominant story in markets since March, and with the “left tail risk” issue so clearly muted in light of the reclaiming of the “Trump market put,” not to mention the reversal on Chinese tariffs, I get at least one week off from those “ripped from the headline” topics. There is still plenty to assess about the U.S. economy in the weeks and months ahead, and the Dividend Cafe will strive to be the most reliable place you can find for that assessment (I am sad to say, that is a low bar).

But today we won’t say the word “tariff” again, there will be no talk about the President or various policies (though on Monday there will be a lot of that!), and we won’t bounce around to a variety of market stories. I am doing my favorite thing in writing the Dividend Cafe today – picking one topic, and writing to my heart’s content about it.

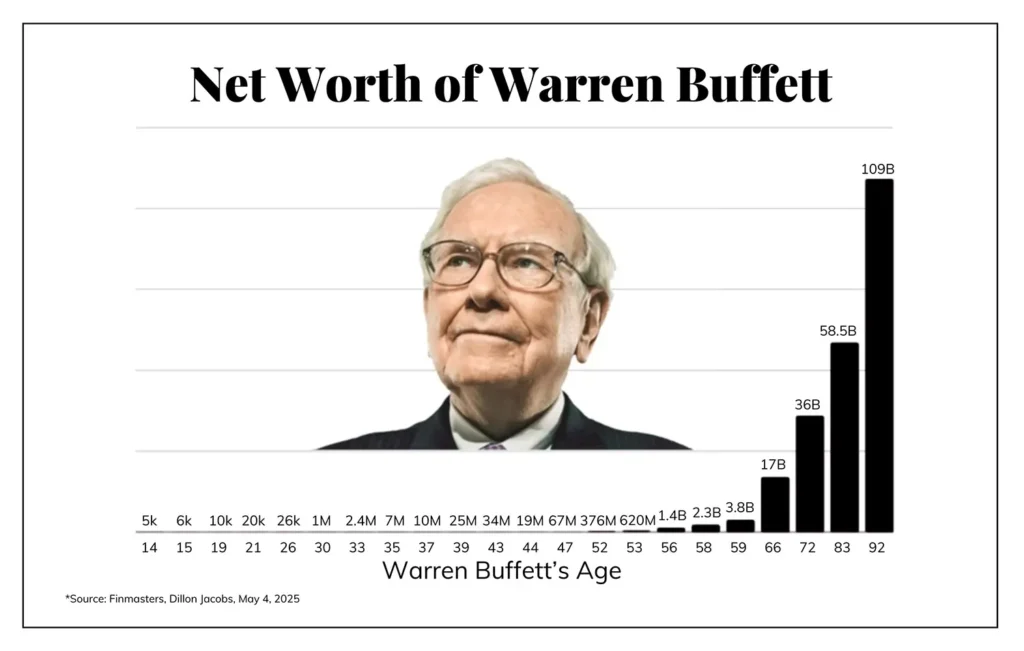

Today’s topic was inspired by the recent announcement of the 94-year-old, Warren Buffett, that he will retire as CEO of Berkshire Hathaway at the end of the year. Worth over $150 billion, Warren Buffett is generally considered to be one of the greatest investors of all time. And like all things that contain such superlative assessment, there is a wide dispersion of opinions behind it. I have some opinions of my own, and those opinions will be the topic of today’s Dividend Cafe. My purpose is actually to be very practical. I don’t think there is a lot of benefit to me saying “he evaluated this well” or “his process of value investing around discounts to intrinsic value was very good” … If his compound annual growth rate and also that, you know, $156 BILLION NET WORTH FIGURE didn’t validate those things, I am not sure what will.

Today, we are looking at a practical breakdown of what made Buffett, Buffett. There are a couple of thoughts here that may surprise you, but I believe are vital to understanding his legacy. And understanding his legacy can only make us all better investors. Did I mention the $156 billion figure?

Let’s jump on in to the Dividend Cafe.

|

Subscribe on |

The Real Secrets to Warren Buffett’s Success: A Practical Breakdown Everyone Can Learn From

The first one is the easiest

Math is not hard in a day and age of calculators, especially HP12c calculators, so let’s just get this part out of the way for those who still do not understand compounding and the time value of money. A great way to turn a measly $376 million into $150 billion is to live for 42 more years (and counting). Yes, having $376 million at age 52 is also helpful, and the 15% annual rate of compounding helps, too. But if you are being honest a move from $376 million to $150 billion sounds like a lot higher of a return than 15%, right? Well, it is a lot higher, in one year. It would be a 39,800% return, to be precise. But the first statement is also true – 39,800% is only 15% per year, when compounded over 42 years. I mean, math really is awesome, right?

Nothing more boring than fundamentals

There are numerous books out there about how Buffett made his money in the early days. My intention in this piece is a little less biographical and a little more conceptual. Yes, he started as an employee of his father’s stock brokerage firm. He joined the great value investor, Benjamin Graham, and in both cases he was a good earner – $15,000 or so, well above the average pay in the 1950’s. But you know, not quite, ummm, “millionaire.” But regardless, he was a very thoughtful analyst and very skilled at his craft of discounted cash flow analysis. It served him well as a young man.

So he kept earning, kept saving, kept investing, and kept compounding. There can’t be any denial that he was better at earning, better at saving, and better at investing than most – but this is still hardly the sensationalistic story it would be come at this point. He had $1 million at age 30, and by 1965 he had become the controlling shareholder of Berkshire Hathaway. The fun part of his history – the partnerships he bought in his early 30’s and how he took over Berkshire are available in more definitive biographies (I have not read all of them but I have read enough Roger Lowenstein to know that you will not be disappointed with his, old as it is).

There is a world of history in Buffett’s purchase of See’s Candies in the 1970’s, or the drama of what he went through with Salomon Brothers in the 1990’s. I actually love this stuff, but I’ll let you read the history elsewhere. For now, my two simple points are:

(1) Warren Buffett became Warren Buffett because of time and compounding, and:

(2) What Warren Buffett did to have something to compound in the early, formative years, and the way he compounded in his 20’s and 30’s was basic fundamentals. Earning. Saving. Investing. All well. And then math.

But wait, there’s more

Embedded in the fundamentals, time, and compounding are a few things that simply do not happen for many people, because you may have noticed that most people do not accumulate $30 million by age 40 or $376 million by age 52. But from $1 million at age 30 to $30 million at age 40, both of those things are exponentially more common than $150 billion at age 94. In fact, there are 1.9 million people under the age of thirty in America who are millionaires – 1.9 million. The issue I am most interested in for our Dividend Cafe purposes is the true secret of the Oracle of Omaha. And I have a theory of the case that really doesn’t start until Mr. Buffett was in his 50s and 60s…

Another easy one

I will add a third to the list we are working on in my five considerations about Buffett’s wealth accumulation, and this one has also been talked about a lot over the years:

(3) Self-reinforcing benefits of being Warren Buffett

This one is unhelpful for the Dividend Cafe. Telling people we own Blackstone stock doesn’t make it more valuable. Buffett’s mere presence in a given company, let alone a sizable ownership stake, is, itself, a value-creator. The credibility, the validation, the amount of capital (because of size and scale), and the affiliation itself become part of the value. From railroad investments to distressed financial companies, there has been a significant premium in Buffett’s return achievements as a result of, well, Buffett making the investments. This doesn’t explain much about his 20s, 30s, 40s, or even 50s, but it explains a lot about the last thirty years. Let’s not begrudge him this premium, but let’s not assume it is coming to us any time soon.

One more anecdote before the grand finale

I have to get another in real quick before I go for the lead story.

(4) Buffett was a voracious reader

I am sorry to incorporate this side agenda of mine into this piece, but I believe it with every ounce of breath in my body. I am fond of this quote from former Defense Secretary and four-star general Jim Mattis:

“If you haven’t read hundreds of books, you are functionally illiterate, and you will be incompetent, because your personal experiences alone aren’t broad enough to sustain you.”

~ Gen. Jim Mattis

I am stunned on a daily basis by the number of traders and portfolio managers I meet who do not read. But I am far more stunned by the number of adults I meet, period, who do not read. There is a certain critique of higher education here, I suppose, where great books are less prioritized (or fully de-prioritized) as some sort of artifact of a flawed Western civilization that fails to capture the proper sociological or psychological strands of what is worth contemplating. And I am sure I could say more on this topic, but I don’t want to become too distracted. I talk to CEO’s, stewards of money, entrepreneurs, and all-purpose organizational leaders every single day – and without exception, there is no delineation between those who are readers and those who are not. Whether it is history, biography, philosophy, or plain old equity research, Buffett read, and read a lot, and gained knowledge, insight, and wisdom from being a reader.

But reading does more for a human than just impart knowledge. It grows the muscle that is used for future accumulation and application of knowledge. It serves as an exercise for the development of the brain. It gives information, but it also gives a framework for processing information. Readers will be leaders (as I have been telling my kids since they were born). Maybe I should add “and they might be worth $150 billion”?

The Human Factor

Many others have pointed out the basic realities that Buffett benefited from:

(1) Time/compounding

(2) Fundamentals/skill/discipline

(3) Self-reinforcement advantage

and

(4) Reading

All of these things are indisputable realities in the success story that is Warren Buffett, but they do not warrant a Dividend Cafe – too many others could have, or have, said the same. What I would like to say about the success of Warren Buffett over the decades is something that I believe truly applies to all of us – to investors, to entrepreneurs, to executives, to leaders, to any human being looking to flourish in a modern economy (which is why this is not really about accumulating $150 billion):

(5) Warren Buffett understood and lived out the reality of human connection. He invested in the social networks that made his success possible

I first became interested in this subject by reading the brilliant sociologist from the University of Virginia, James Davison Hunter, who talked about “thick networks” and the affiliations of elites as transformational in history. Those broader cultural narratives Hunter described made a lot of sense to me at a macro and historical level, but also seemed to me to apply to individual and micro (bottom-up) formation. Those who know a lot of people get introduced to a lot more ideas. They are exposed to a lot more opportunities. And if done right, they likely have connections, resources, and relationships in diverse sectors and geographies.

One whose entire network is in their own community may very well have all the friendships they need, and I am a huge fan of subsidiarity, localism, and strong community ties. But I would suggest that the great investors, entrepreneurs, and business leaders will have more than one zip code covered in their Rolodex.

I lack the extrovert personality of Buffett to ever do this, and get overwhelmed as a hyper-introvert even thinking about it, but he was constantly, and I mean constantly, gathering friends, leaders, connections together for meetings, salons, trips, and gatherings. These networks were built and compounded throughout his life, the same way capital does – slowly, then suddenly. Buffett somehow tapped into one of the greatest realities of the human race – that the greatest wealth exists in the spirit and ingenuity of human beings. Idea sharing, insights, debates – these basic human activities that smart people do when they are involved in each other’s lives – became a business (and I am sure, personal) lifestyle for Warren Buffett for decades. That compounding mattered.

In fact, it mattered to the tune of 39,800%.

Conclusion

Look, I will be very surprised if anyone reading this, let alone the person writing it, accumulates $150 billion in their lifetime. But the goal in this writing is actually not about Buffett’s net worth. It is about the best practices of successful people that sometimes leave clues for the rest of us. Not everyone lives to be 94 (and counting), but the math of compounding does apply to everyone while they are alive. Not everyone is as smart as Warren Buffett, but discipline is much less intellectual and much more about habit formation. The self-fulfilling prophecy benefit is not easily achieved. And reading is either something you believe me about or you don’t.

But there is nothing more universally true and available in this Dividend Cafe than this simple takeaway: Economics is the study of human action around the allocation of scarce resources, and human beings were created by God with tremendous capacity to do great things. Intellectually, professionally, medically, scientifically, academically, athletically, entrepreneurially – there is a collective of inspiration, wisdom, resources, experience, and capability in human beings that can change our lives and careers.

In the human person, we find the God-given attributes that are worth compounding. And if we can learn anything from Warren Buffett in our investing and business lives, it is that information and analysis compound at one rate, and relationships and social capital compound at an even greater rate. Go and do likewise.

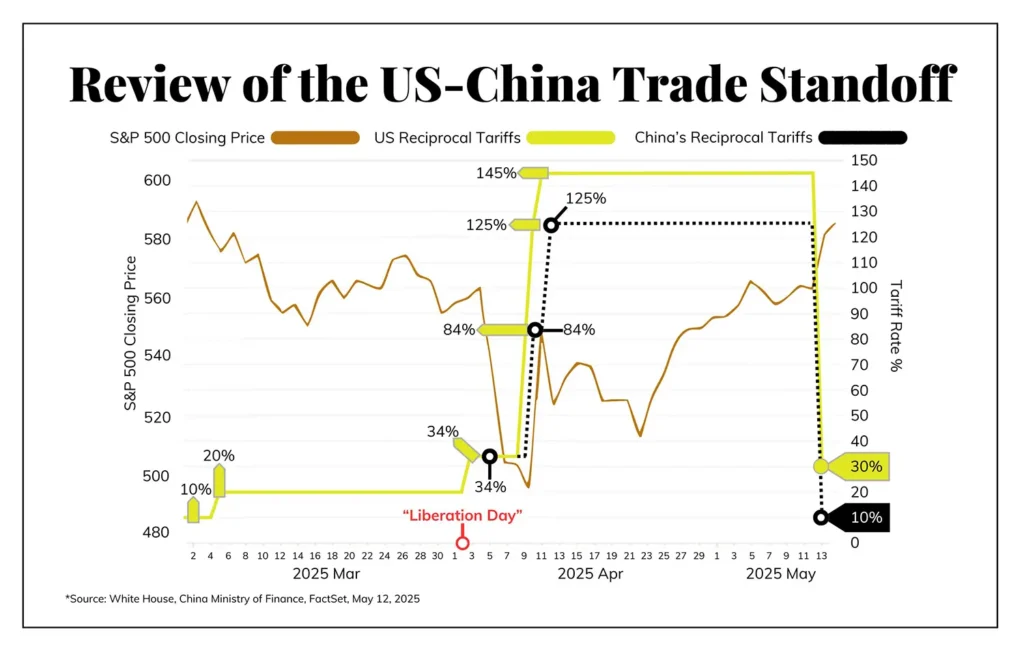

Chart of the Week

Inspired by my friend, Michael Poulos, we took this fascinating picture of the trade war’s on-again, off-again reality over the last two months, and juxtaposed it with the stock market itself. A picture tells a thousand words, or in this case, four words: “Markets. Don’t. Like. Tariffs.”

Quote of the Week

“We don’t have to be smarter than the rest. We have to be more disciplined than the rest.”

~ Warren Buffett

**********

I do not know what next week holds, but I do know I will be doing a lot of reading, learning, and connecting over the next week to compound my abilities as a Portfolio Manager, Wealth Advisor, and author of the Dividend Cafe, as much as possible. And I know that I will be rooting for the Knicks tonight in Madison Square Garden like it is my job. I may even learn a few things from the people I’ll be with at the game. To that end, I work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet